Tether, A controversial stable coin

6 Apr, 2020

Category: Financials

Tags: Crypto

Tether is a cryptocurrency token pegged to the US dollar. 1 Tether (USDT) is always equivalent to 1 US dollar (USD). To use an analogy, Tether is a bit like a casino chip, and this chip is affecting the price of a billion-dollar size asset class.

Related Articles

Inflation = Money Supply > Goods & Service produced

2023-08-09

|

Financials

|

Tags: Inflation

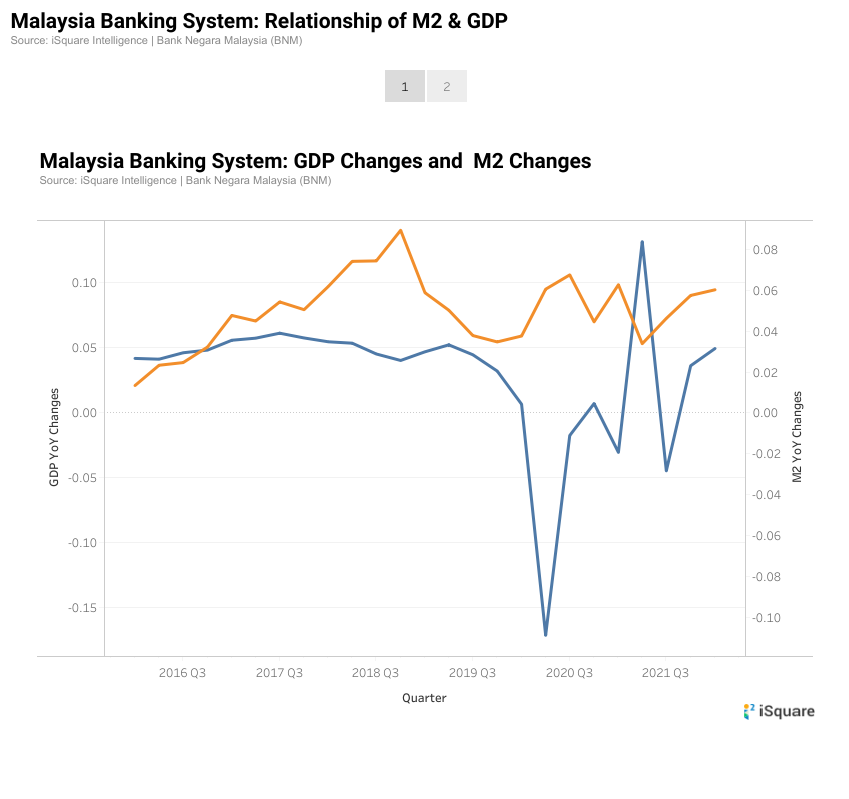

A closer look at Malaysia's money supply and GDP

Is the Commodities Prices at the Verge of Turn Around

2023-08-09

|

Financials

|

Tags: Precious Metal

|

Archived

Geopolitical risk, macroeconomic policy, and under investment due to prolonged low commodities price over the years has created the best environment for commodities prices to move.

Reasons for SGD to ease and its implication

2023-08-09

|

Financials

|

Tags: Portfolio

|

Archived

The Monetary Authority of Singapore (MAS) has hinted at a weaker Sinngapore Dollar in order to stimulate the economy. What are the effects and the implications due to this easing?