Inflation = Money Supply > Goods & Service produced

7 Jun, 2022

Category: Financials

Tags: Inflation

A closer look at Malaysia's money supply and GDP

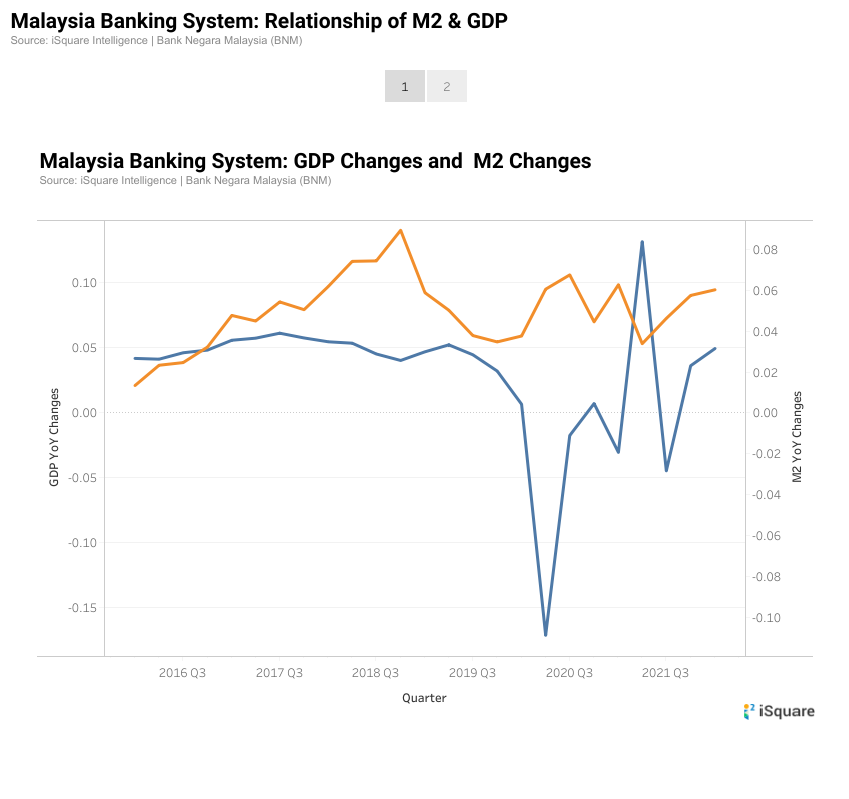

Source: iSquare Intelligence M2 and GDP Relationship

The changes in M2 and GDP reflect the relationship between money supply and the goods and services produced in the same period. When the YoY growth rate for M2 is larger than the GDP growth rate, there is a high chance the economy will experience inflation in the near term.

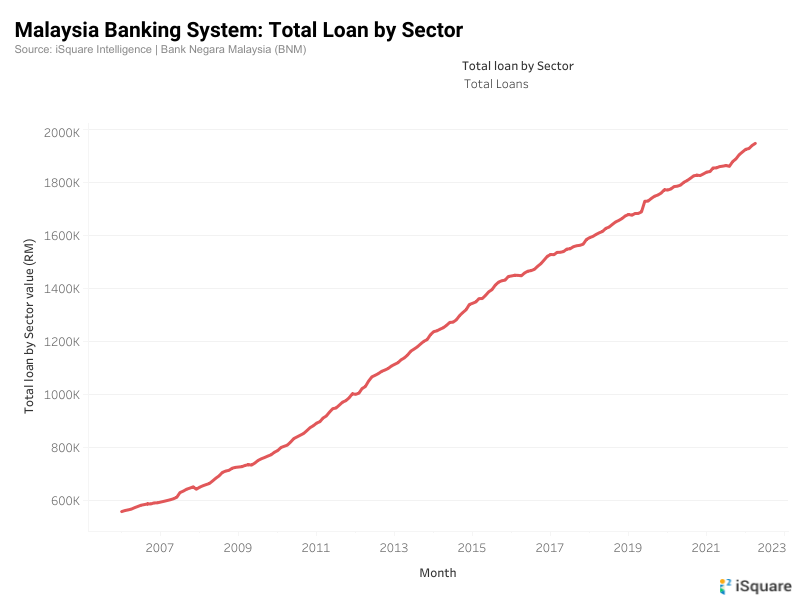

Source: iSquare Total loan by sector

Money is created when a loan is created. If you check out the total loan created by the Malaysia banking system, you will be surprised that our total loan has accelerated since Aug 2021.

Every sensible person will borrow more money during the high inflation era and use it to purchase hard assets, especially when the interest rate is lower than the inflation rate. Hence, inflation is not going anywhere soon until the speed of the money supply decelerates.

Related Articles

What's next for Stablecoin

2023-08-09

|

Financials

|

Tags: Crypto

What are the near-term risks for the crypto industry?

Is the Commodities Prices at the Verge of Turn Around

2023-08-09

|

Financials

|

Tags: Precious Metal

|

Archived

Geopolitical risk, macroeconomic policy, and under investment due to prolonged low commodities price over the years has created the best environment for commodities prices to move.

Reasons for SGD to ease and its implication

2023-08-09

|

Financials

|

Tags: Portfolio

|

Archived

The Monetary Authority of Singapore (MAS) has hinted at a weaker Sinngapore Dollar in order to stimulate the economy. What are the effects and the implications due to this easing?