Updates on US Interest Rate Cycle

22 Jul, 2022

Category: Portfolio

Tags: Interest Rate

The interest rate hiking cycle is ending very soon.

Related Articles

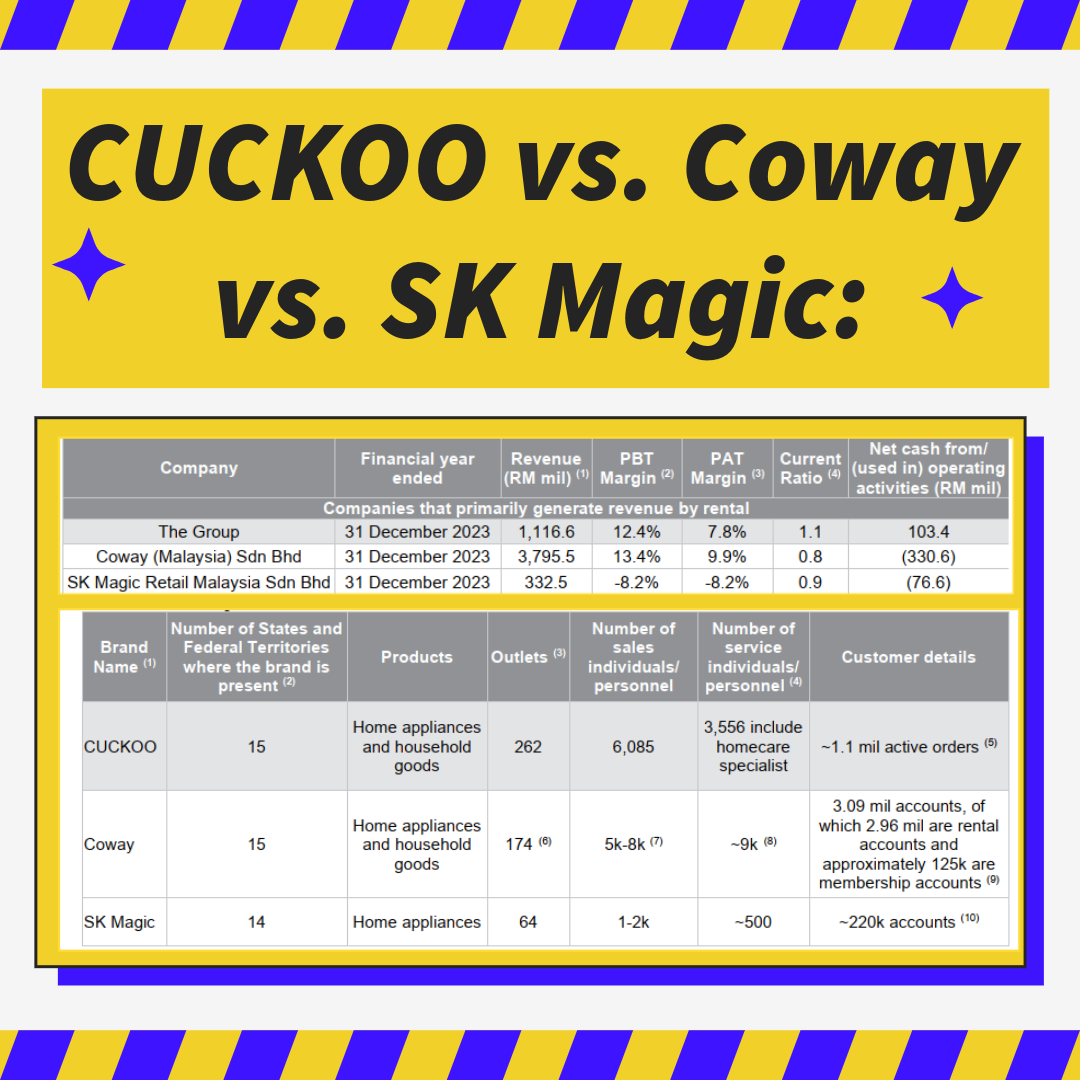

Cuckoo vs Coway

2024-11-03

|

Portfolio

|

Tags: Cuckoo

Comparison of household products leasing provider

Personal Investment Portfolio

2024-04-03

|

Portfolio

|

Tags: Portfolio

|

Private Archived

Personal Investment Portfolio that includes stocks, bonds, ETFs, futures and options.

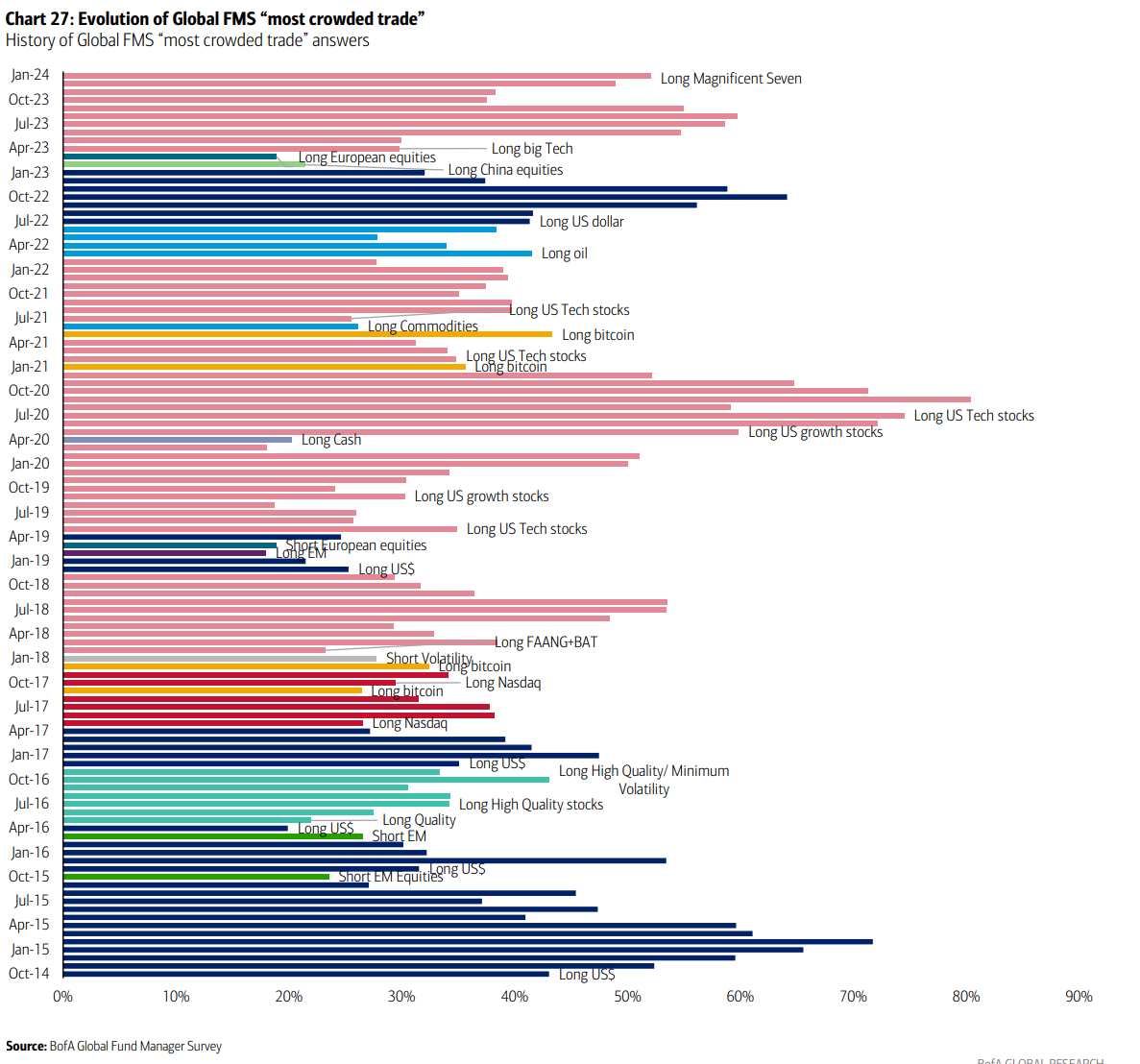

Don't Follow the Crowd

2024-03-26

|

Portfolio

|

Tags: Open Interest

Why Being a Contrarian Matters