Don't Follow the Crowd

26 Mar, 2024

Category: Portfolio

Tags: Open Interest

Why Being a Contrarian Matters

📉 Don't Follow the Crowd 📈

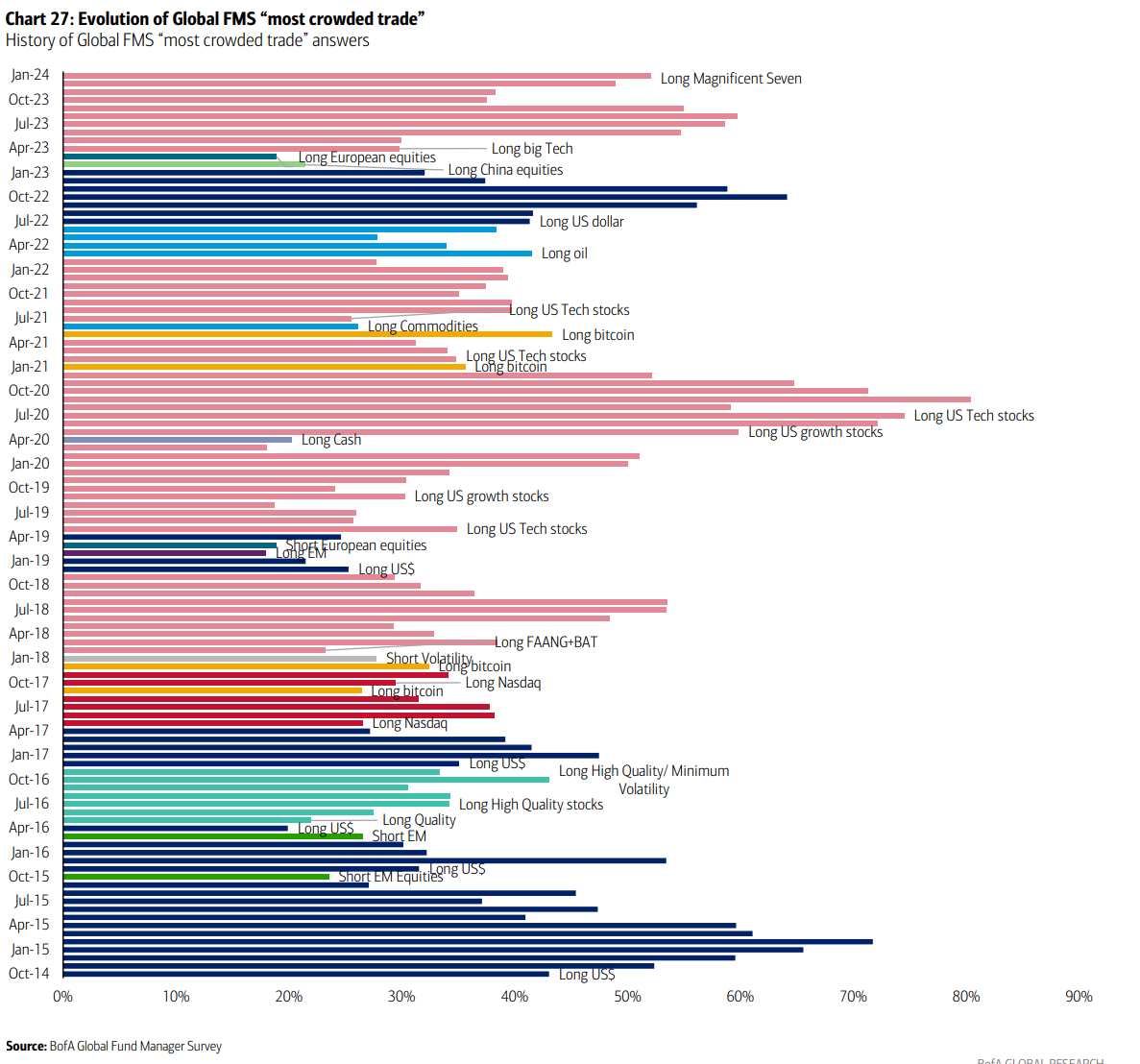

It's no secret that the most crowded trade is often the

wrong trade. Just take a look at history: in October 2017 and April 2021,

everyone was going long on Bitcoin, only for it to experience its highest highs

during those periods. And let's not forget about July 2021, when everyone was

jumping on the long commodities bandwagon, right before commodities took a

dive.

Personally, I learned this lesson the hard way in January

2023. Long China equities seemed like a no-brainer at the time, but I ended up

losing big money when China's stock market failed to perform compared to India

or Japan.

Fast forward to March 2024, and we're seeing a similar

trend. The 'magnificent 7' (Alphabet, Amazon, Apple, Meta Platforms, Microsoft,

NVIDIA, and Tesla), Japan, and Bitcoin are the most crowded trades, while

bearish bets on Chinese equities is the second most crowded trade.

Now, I'm not saying you should necessarily take the opposite

side of these trades. But it's worth noting that the price of options on the

opposite side is very cheap, and the risk-reward ratio makes sense.

In a market where everyone is going one way, sometimes it

pays to go the other. After all, the most profitable opportunities often lie in

the places others aren't looking.

Related Articles

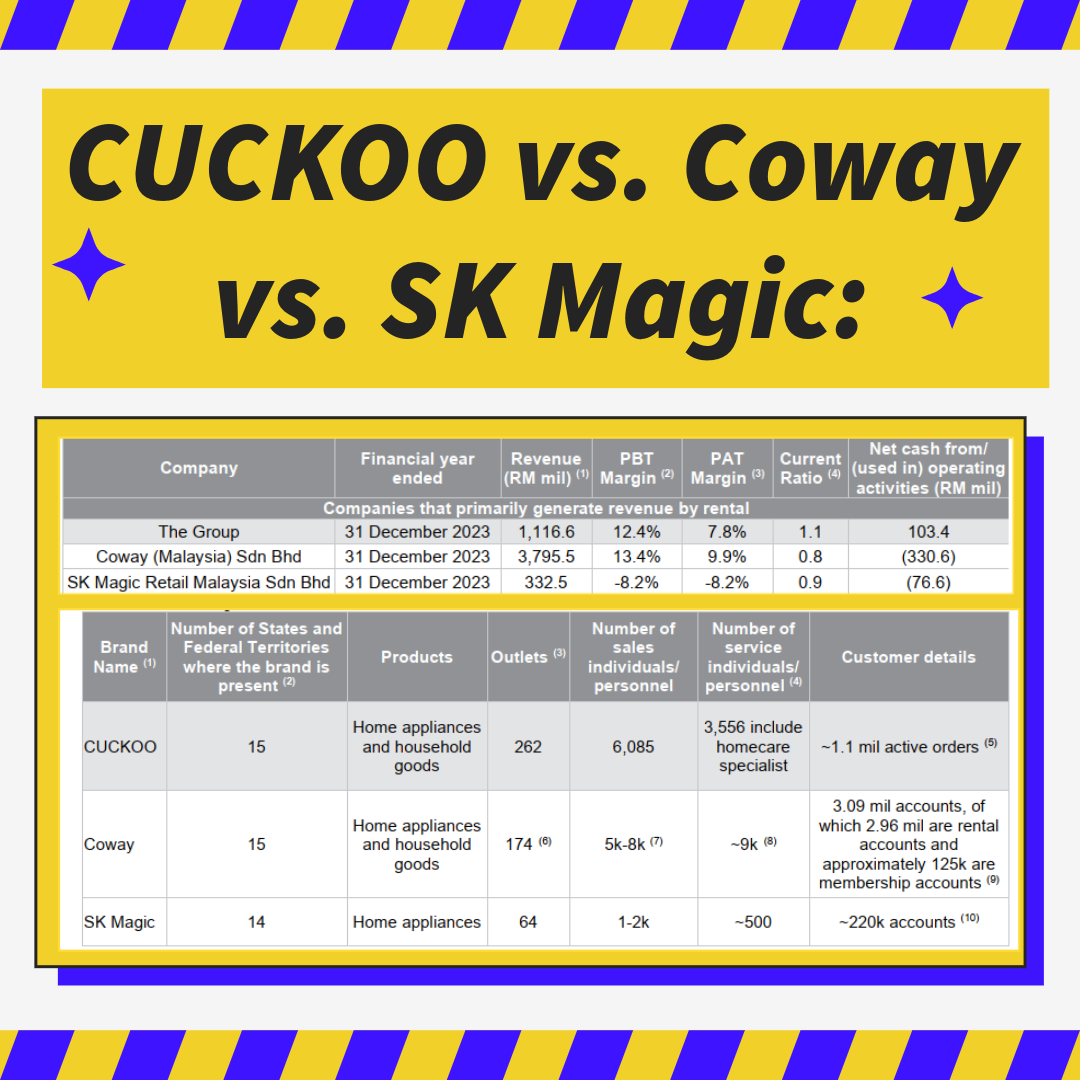

Cuckoo vs Coway

2024-11-03

|

Portfolio

|

Tags: Cuckoo

Comparison of household products leasing provider

Personal Investment Portfolio

2024-04-03

|

Portfolio

|

Tags: Portfolio

|

Archived

Personal Investment Portfolio that includes stocks, bonds, ETFs, futures and options.

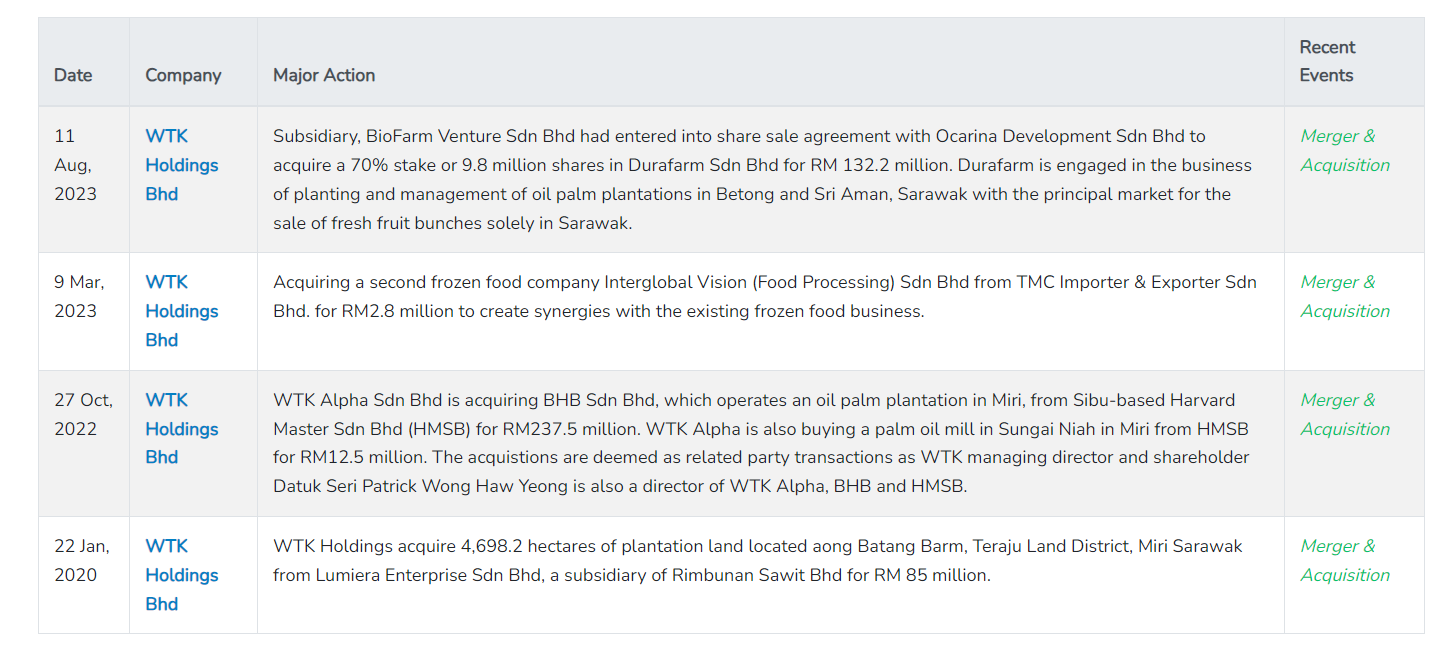

Cracking Open the WTK Holdings Story

2023-08-14

|

Portfolio

|

Tags: WTK

WTK Holdings Bhd is expanding aggressively