Sector Rotation

Sector rotation is the movement of money invested in stocks from one industry to another as investors and traders anticipate the next stage of the economic cycle. The economy moves in reasonably predictable cycles.

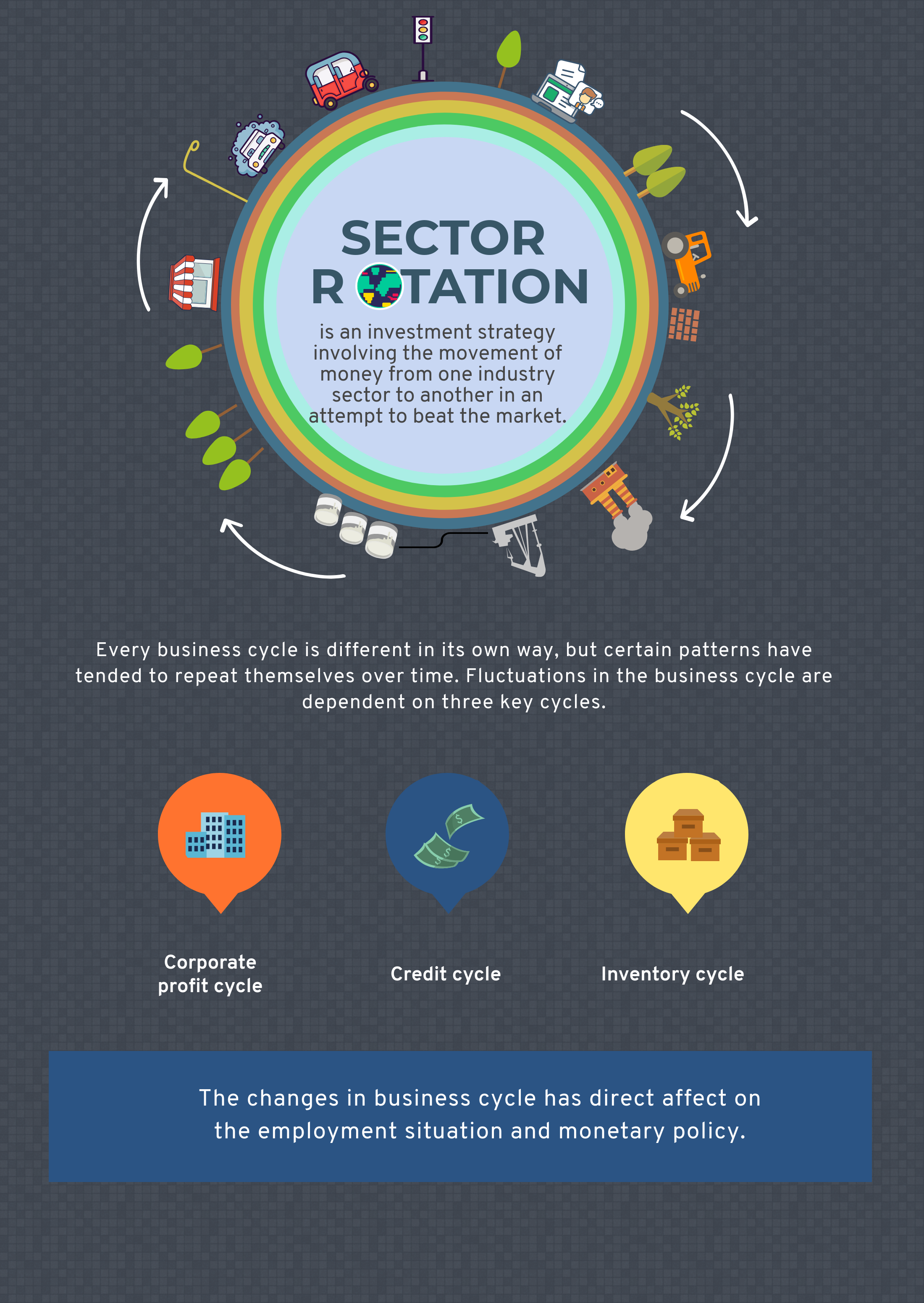

What is Sector Rotation?

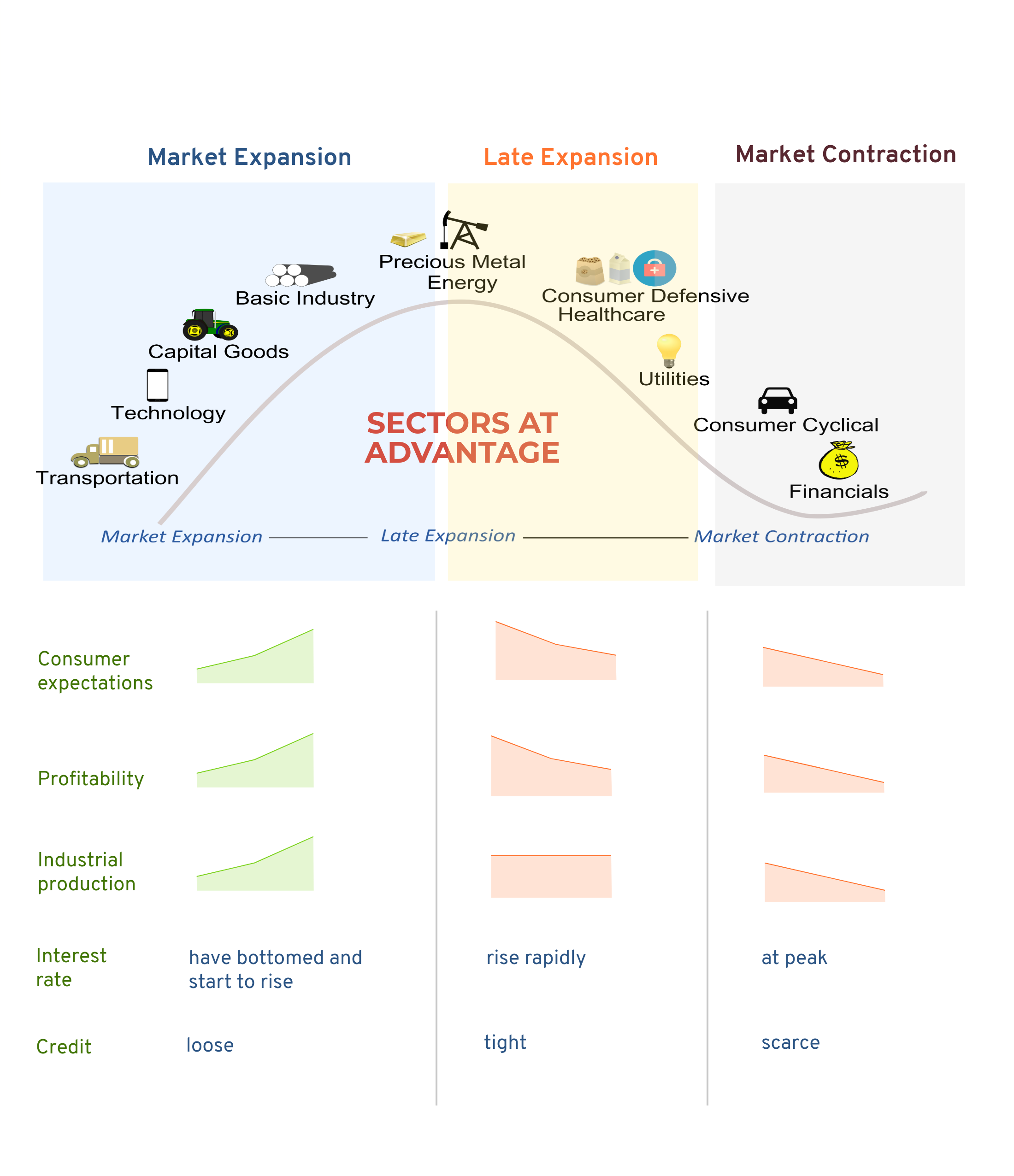

Sector rotation is an investment strategy involving the movement of money from one industry sector to another in an attempt to beat the market. To implement a sector rotation strategy, investors deploy a “top-down” approach. This involves an analysis of the overall market—including monetary policy, interest rates, commodity and input prices, and other economic factors. This can help investors assess the current economic environment and determine the current phase of the business cycle.

Key economic factors for each sector or industry can also help you create an estimate of future performance for each sector. Depending on the phase of the business cycle, certain sectors may be expected to outperform others.

Every business cycle is different in its own way, but certain patterns have tended to repeat themselves over time. Fluctuations in the business cycle are dependent on three key cycles—the corporate profit cycle, the credit cycle, and the inventory cycle—as well as changes in the employment situation and monetary policy.

Economic Cycle in Four Stages

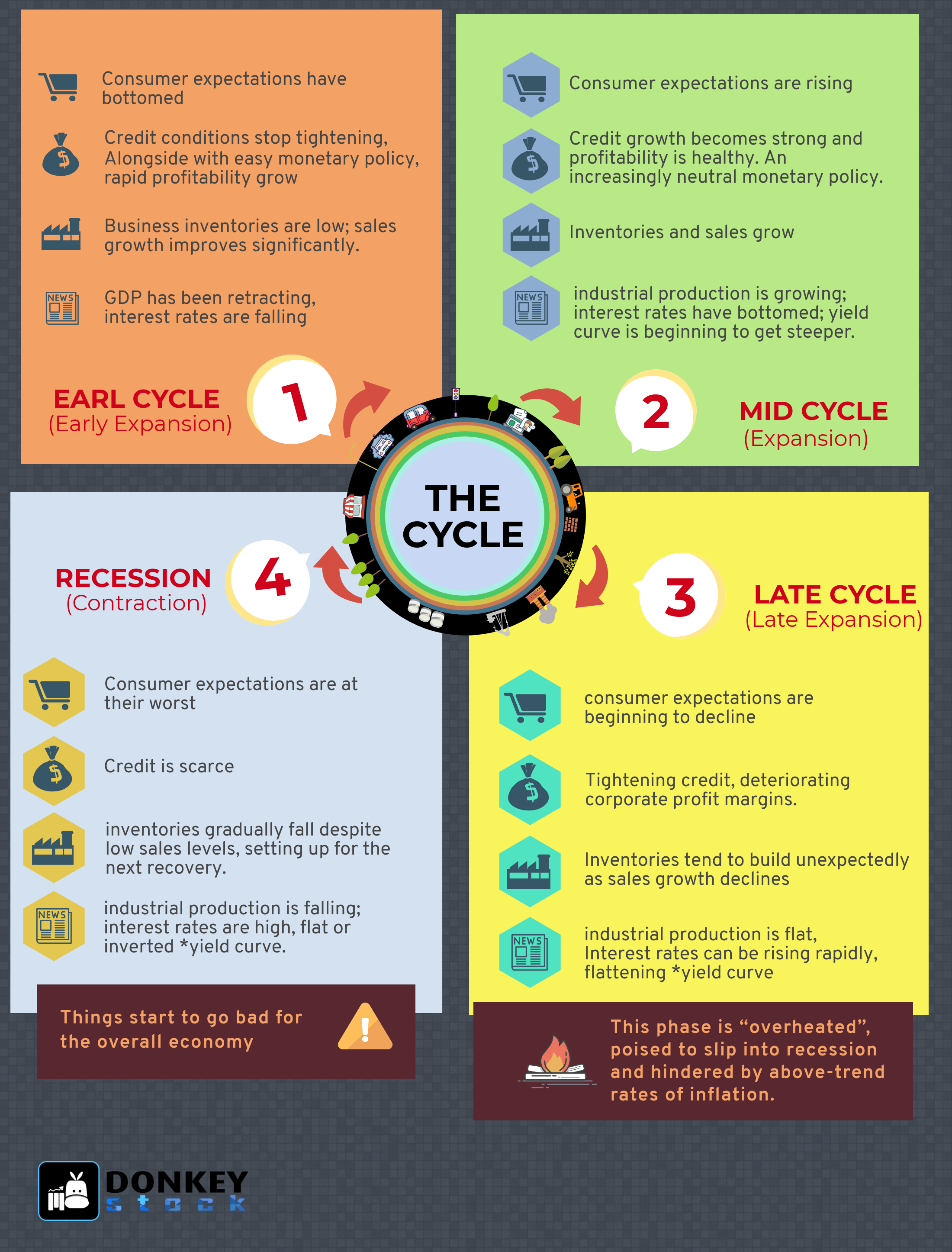

Early Cycle

GDP has been retracting, interest rates are falling; consumer expectations have bottomed, and the yield curve is normal. Credit conditions stop tightening alongside easy monetary policy, creating a healthy environment for rapid profit margin expansion and profit growth. Business inventories are low, while sales growth improves significantly.

Sectors that have profited most in this stage include:

Cyclical, Financial and transports (near the beginning)

Technology

Industrials/Capital Goods (near the end)

Mid Cycle

Consumer expectations are rising; industrial production is growing; interest rates have bottomed, and the yield curve is beginning to get steeper. The longest phase of the business cycle. Credit growth becomes strong and profitability is healthy. An increasingly neutral monetary policy. Inventories and sales grow, reaching equilibrium relative to each other.

Sectors that have profited most in this stage include:

Industrials/Capital Goods (near the beginning)

Basic materials

Energy (near the end)

Late Cycle

Interest rates can be rising rapidly, flattening yield curve; consumer expectations are beginning to decline, and industrial production is flat. This phase is “overheated”, poised to slip into recession, and hindered by above-trend rates of inflation. Tightening credit, deteriorating corporate profit margins. Inventories tend to build unexpectedly as sales growth declines.

Sectors that have profited most in this stage include:

Energy (near the beginning)

Staples/Consumer Defensive

Healthcare Services (near the end)

Recession

Things start to go bad for the overall economy. Consumer expectations are at their worst; industrial production is falling; interest rates are high, flat, or inverted yield curve. Credit is scarce and inventories gradually fall despite low sales levels, setting up for the next recovery.

Sectors that have profited most in this stage include:

Healthcare Services (near the beginning)

Utilities

Cyclical, Financial and transports (near the end)

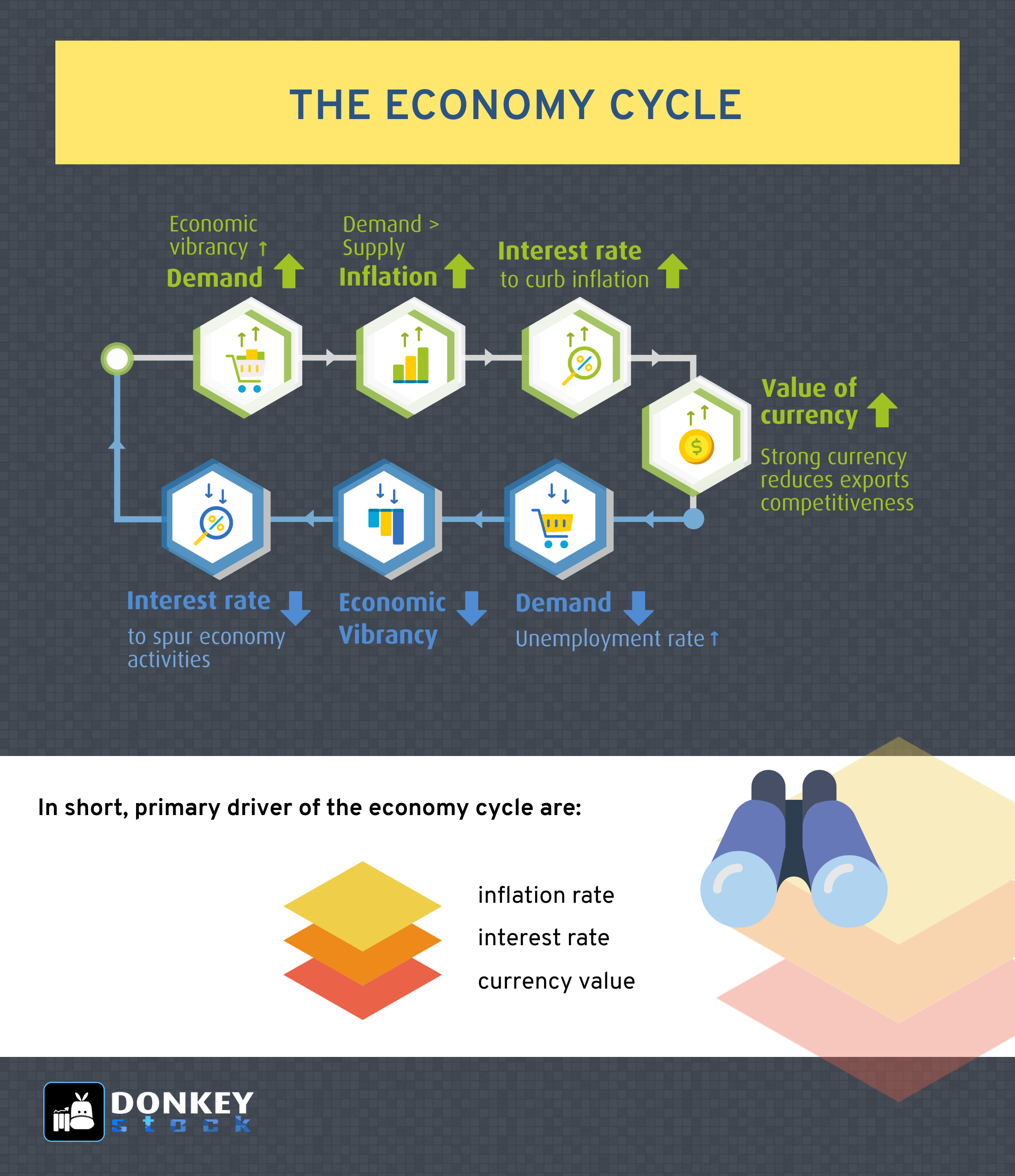

The primary driver of sector rotation is currency value, inflation level, and interest rates. As the economy expands, demand for raw materials creates inflationary pressures, which in turn prompt higher interest rates, which increase the value of the currency, which reduces the competitiveness of a country’s exports as the currency causes them to cost more to other countries. This final stage causes the economy to contract, reducing demand for raw materials, which creates deflationary pressures, which in turn prompt lower interest rates, which decrease the value of the currency, which increases the competitiveness of a country’s exports—creating a new market cycle.

Risk

By adopting a sector rotation strategy, you run the risk that your portfolio may experience increased volatility and may underperform the broader market indexes. In addition, diversification reduces risk.

Related Guides

Mental for Value Investing

2022-01-18

|

Guide

|

Tags: Portfolio

Value investing is an investment strategy that involves picking stocks that appear to be trading for less than their intrinsic or book value.

Types of yield curve and its impact to the market

2021-11-26

|

Guide

|

Tags: Portfolio

Yield Curve is a graph that shows how bond yields and maturities are related. Here are the types of the yield curve, factors affecting the yield curve and how the market interpret the different type of yield curve

Types of Coal

2021-11-25

|

Guide

|

Tags: Portfolio

Coal is an abundant natural resource that can be used as a source of energy and is primarily used as fuel to generate electric power. The article illustrates the major types or ranks of coal