Mental for Value Investing

Value investing is an investment strategy that involves picking stocks that appear to be trading for less than their intrinsic or book value.

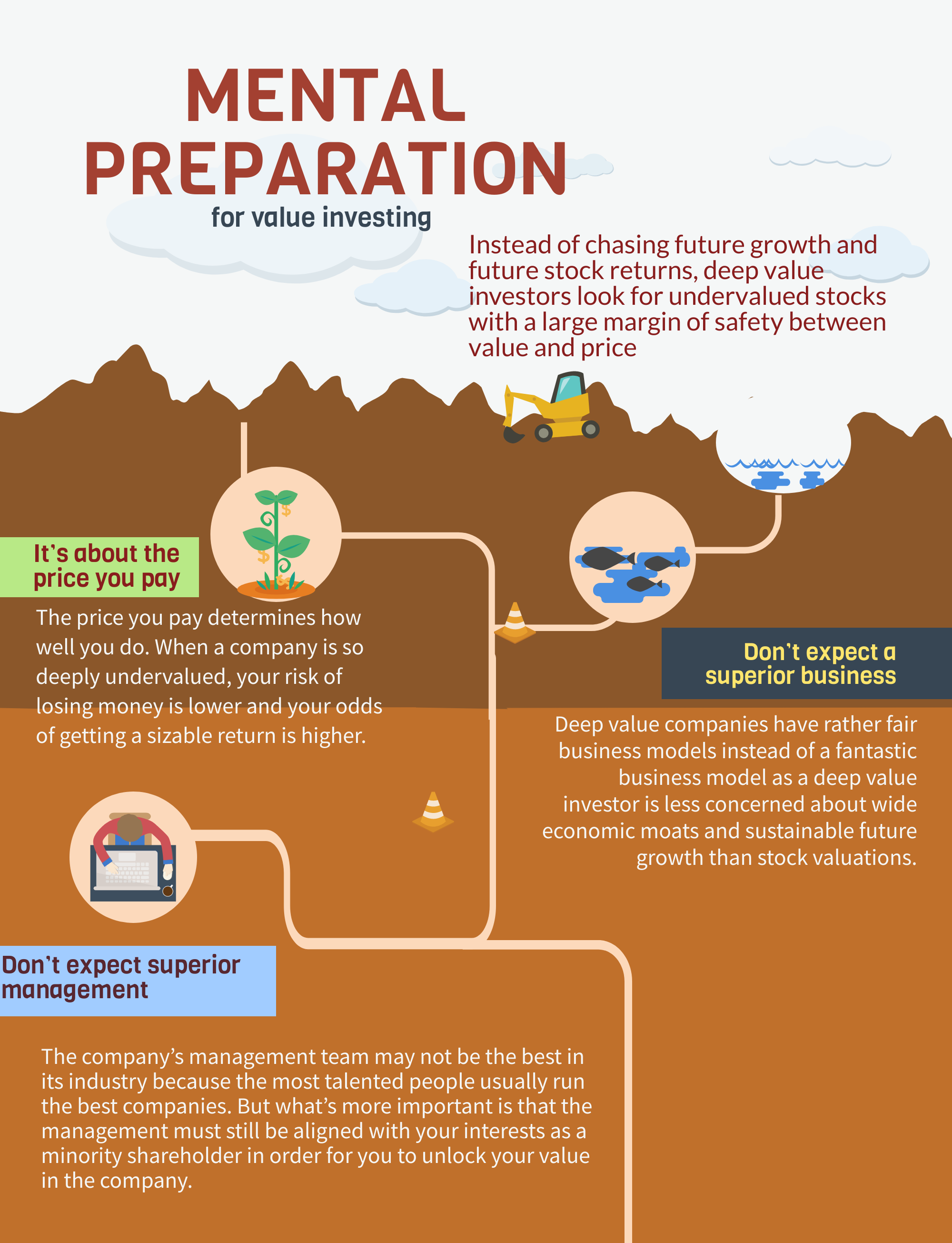

Things to know before going into value investing

Instead of chasing future growth and future stock returns, deep value investors look for undervalued stocks with a large margin of safety between value and price.

It’s about the price you pay

The price you pay determines how well you do. When a company is so deeply undervalued, your risk of losing money is lower and your odds of getting a sizable return is higher. There is a reversion to the mean.

Don’t expect a superior business

Deep value companies have rather fair business models instead of a fantastic business model as a deep value investor is less concerned about wide economic moats and sustainable future growth than stock valuations.

Don’t expect superior management

The company’s management team may not be the best in its industry because the most talented people usually run the best companies. But what’s more important is that the management must still be aligned with your interests as a minority shareholder in order for you to unlock your value in the company.

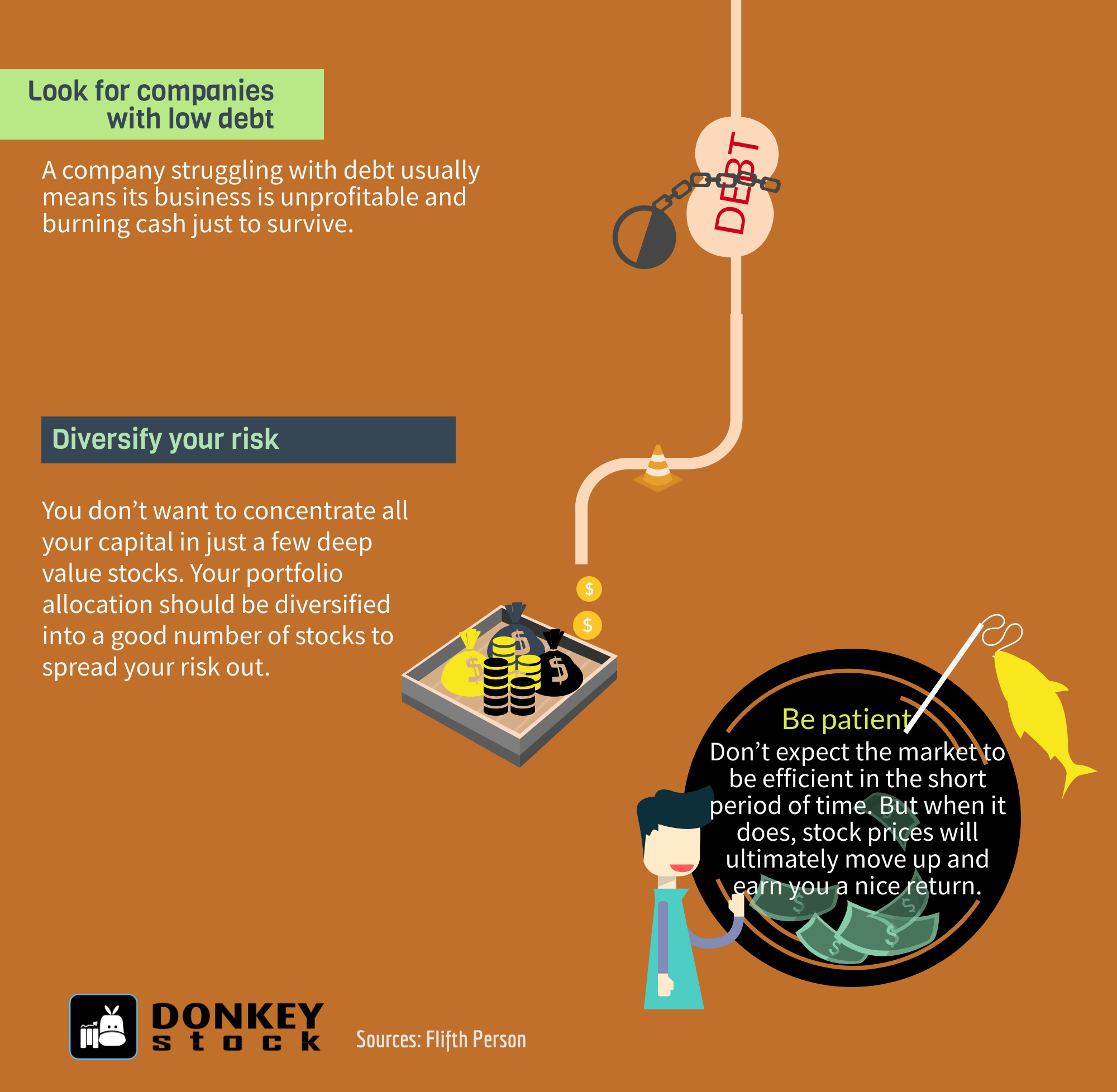

Look for companies with low debt

A company struggling with debt usually means its business is unprofitable and burning cash just to survive.

Diversify your risk

You don’t want to concentrate all your capital on just a few deep-value stocks. Your portfolio allocation should be diversified into a good number of stocks to spread your risk out.

Be patient

Don’t expect the market to be efficient in a short period of time. But when it does, stock prices will ultimately move up and earn you a nice return.

In short, investing is more an art than a science and there is no point in arguing which method is superior. As for value investors, the most important thing is to beware of Value Trap.

Related Guides

Types of yield curve and its impact to the market

2021-11-26

|

Guide

|

Tags: Portfolio

Yield Curve is a graph that shows how bond yields and maturities are related. Here are the types of the yield curve, factors affecting the yield curve and how the market interpret the different type of yield curve

Types of Coal

2021-11-25

|

Guide

|

Tags: Portfolio

Coal is an abundant natural resource that can be used as a source of energy and is primarily used as fuel to generate electric power. The article illustrates the major types or ranks of coal

Bursa Listing Requirement

2021-07-06

|

Guide

|

Tags: Merger & Acquisition

Listing provides an opportunity to the corporates / entrepreneurs to raise capital to fund new projects/undertake expansions/diversifications and for acquisitions. Listing also provides an exit route to private equity investors as well as liquidity to the ESOS holding employees.