How bad a company can be? PN17 & GN3

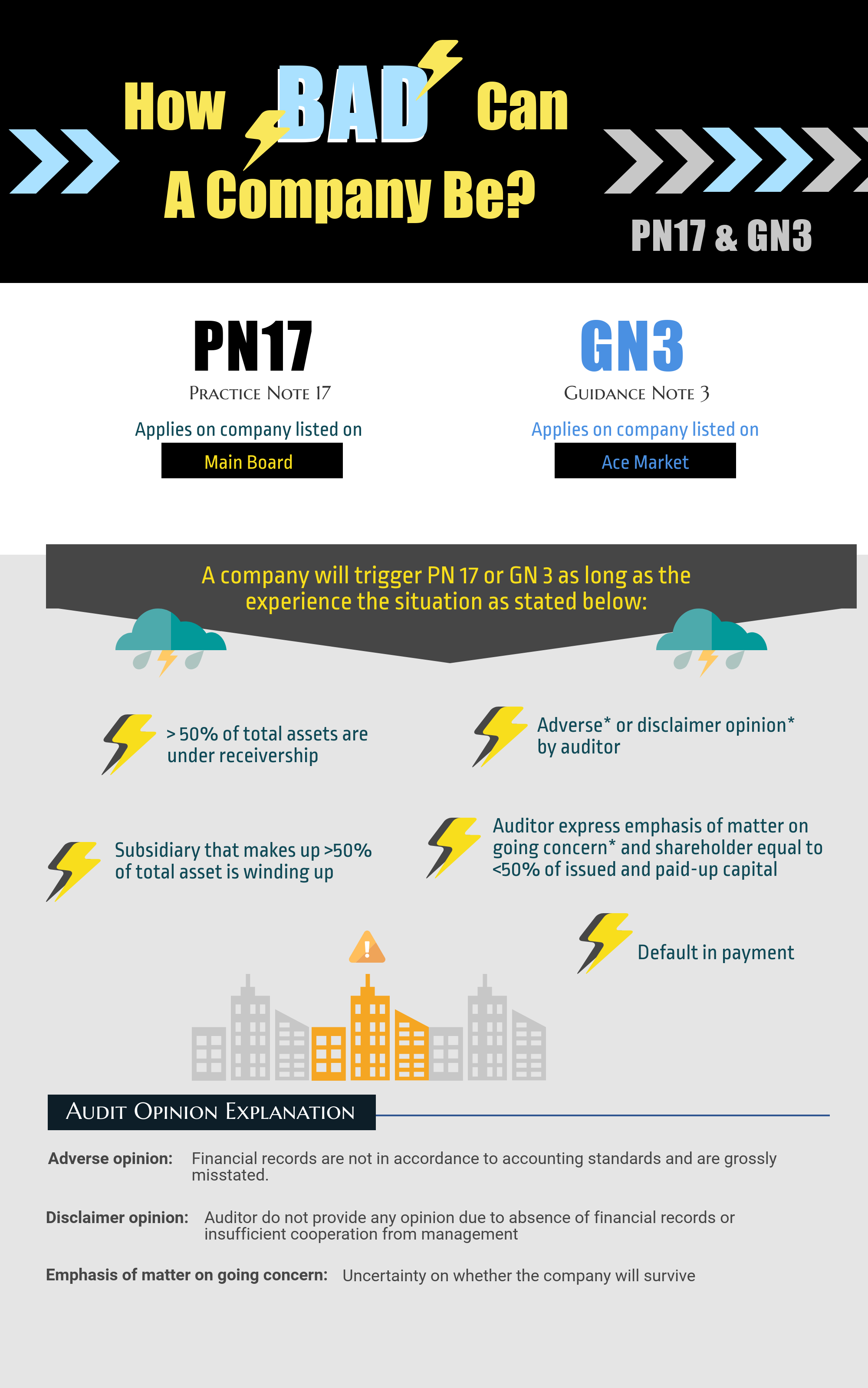

PN17 classification involves financially distressed companies that are listed on Bursa Malaysia's Main Market, while GN3 status refers to distressed companies that are listed on the ACE Market.

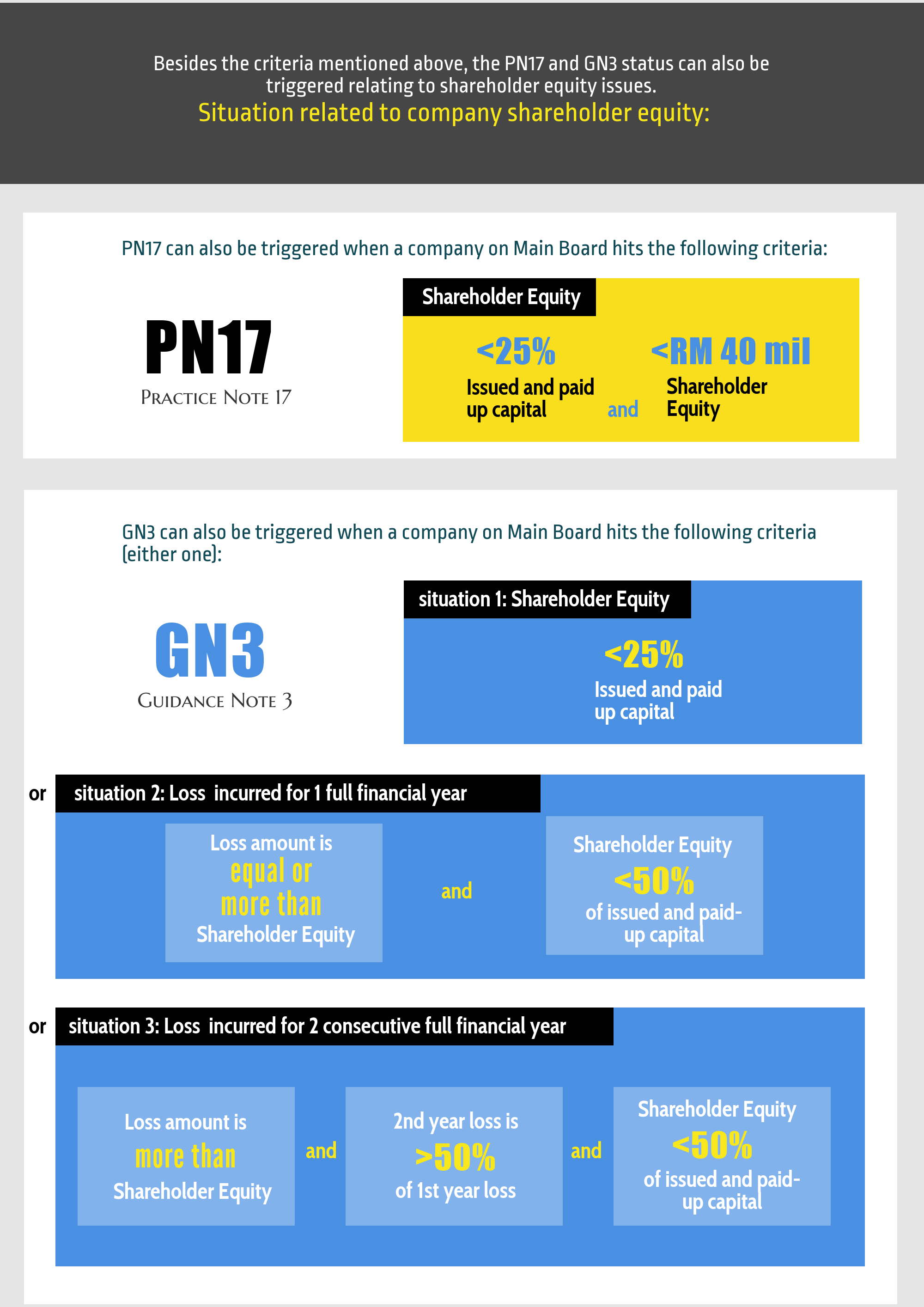

Practice Note 17, also known as PN 17, is triggered as long as a company listed in Main Board hits the following criteria:

Shareholder equity falls below 25% of issued and paid-up capital and shareholder equity is less than RM40 million

Guidance Note 3, also known as GN 3, is triggered as long as a company listed in the Ace market meets the following criteria:

Shareholder equity is less than 25% of issued and paid-up capital

The firm has incurred loss for one full financial year the loss amount is equal to or more than shareholder equity and shareholder equity is less than 50% of issued and paid-up capital

It has incurred loss in two consecutive full financial years and the amount is more than shareholder equity, the second year loss is more than 50% of first-year loss and the shareholder equity is below 50% of issued and paid-up capital

Besides the situation related to shareholder equity, a company will trigger PN 17 or GN 3 as long as they experience the situation as stated below:

50% of total assets are under receivership

A subsidiary that makes up more than 50% of total assets is winding up

Adverse or disclaimer opinion by the auditor

The auditor expresses an emphasis of matter on going concerned and shareholder equity is less than 50% of issued and paid-up capital

The company default in its payment

Adverse Opinion: Financial records are not in accordance with accounting standards or grossly misstated

Disclaimer Opinion: The auditor do not provide any opinion due to the absence of financial records or insufficient cooperation from management

The emphasis of matter on going concern: Uncertainty on whether the company will survive

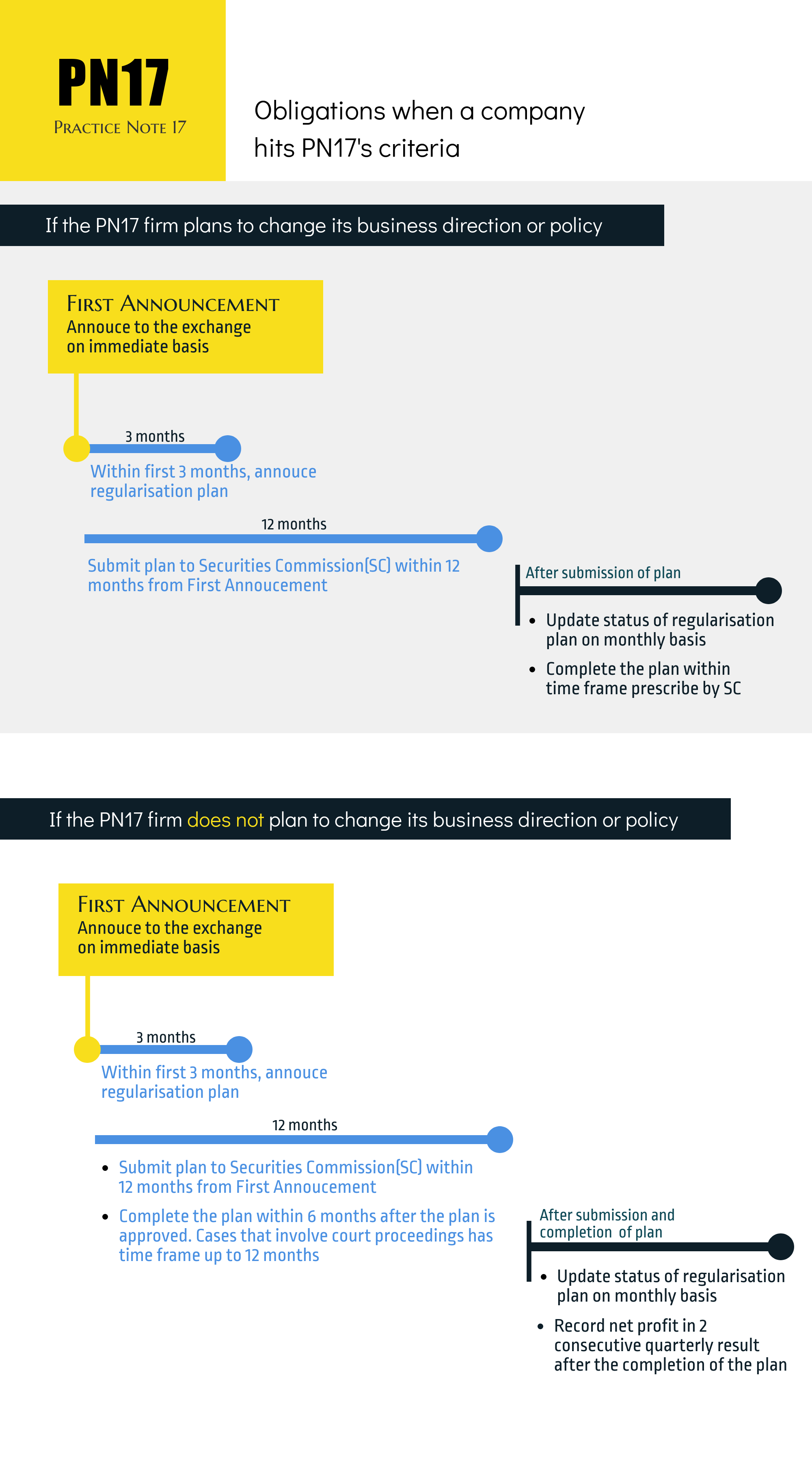

When a company hits the criteria of being a PN17/ GN3 company, they have to announce to the exchange immediately. The below is a timeline of what a company should do when it became a PN17/GN3 company.

If the PN 17 firm plans to change its business direction or policy

Announce a regularization plan within the first 3 months

Submit the regularization plan to the Securities Commission (SC) for approval within 12 months from the First Announcement

Update the status of the regularization plan on a monthly basis

Complete the plan within the time frame prescribed by SC

If the PN 17 firm does not plan to change its business direction or policy

Announce a regularization plan within the first 3 months

Submit the regularization plan to the exchange for approval within 12 months from the First Announcement

Complete the regularization plan within 6 months from the time the plan is approved. Cases that involve court proceedings are being given a time frame of up to 12 months.

Update the status of the regularization plan on a monthly basis

Record a net profit in 2 consecutive quarterly results after the completion of the plan

Action to do by a GN3 Company

Appoint a sponsor within the first 3 months

Submit the regularization plan to the exchange for approval within 12 months from the First Announcement

Complete the regularization plan within 6 – 12 months

Update the status of the regularization plan on a monthly basis

A failure to do so will face a suspension or delisting of the counter.

Some examples of the regularization plan

Divestment of non-core business

Injection of fresh capital via new strategic shareholders

Agreement and compromise with creditors

Share capital reduction

Fundraising via rights issue or private placement

Related Guides

Mental for Value Investing

2022-01-18

|

Guide

|

Tags: Portfolio

Value investing is an investment strategy that involves picking stocks that appear to be trading for less than their intrinsic or book value.

Types of yield curve and its impact to the market

2021-11-26

|

Guide

|

Tags: Portfolio

Yield Curve is a graph that shows how bond yields and maturities are related. Here are the types of the yield curve, factors affecting the yield curve and how the market interpret the different type of yield curve

Types of Coal

2021-11-25

|

Guide

|

Tags: Portfolio

Coal is an abundant natural resource that can be used as a source of energy and is primarily used as fuel to generate electric power. The article illustrates the major types or ranks of coal