Oil price outlook

8 Apr, 2020

Category: Energy

Tags: Crude Oil

The oil market is not just about the supply and demand of oil.

Related Articles

Tokyo Electric Power's Resuming Nuclear Plant

2023-12-28

|

Energy

|

Tags: LNG

Japan resumes its nuclear plant, lesser demand for LNG

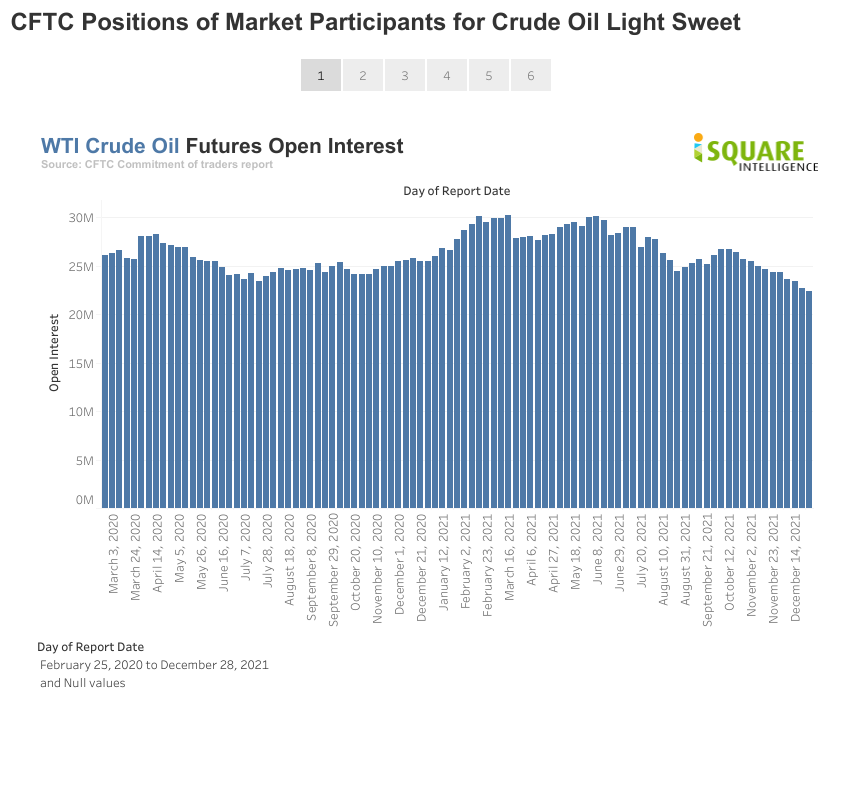

Divergence between oil price and open interest

2023-08-09

|

Energy

|

Tags: Crude Oil, Open Interest, Divergence

The price and volume of crude oil is not showing the same signal recently

Updates on crack spread

2023-08-09

|

Energy

|

Tags: Crack Spread

Refineries are not going to deliver an outstanding Q4 2022 result too