Updates on crack spread

30 Nov, 2022

Category: Energy

Tags: Crack Spread

Refineries are not going to deliver an outstanding Q4 2022 result too

A crack spread is a spread created in commodity markets by purchasing oil and offsetting the position by selling gasoline and heating oil.

An oil refinery is a facility that takes crude oil and distills it into various useful petroleum products such as gasoline, kerosene, or jet fuel.

Hengyuan Refining Co Bhd, a Bursa-listed refinery had seen its share price plunging today after delivering a loss-making quarter result. The company may also deliver an unsatisfactory result for Q4 2022 as the crack spread had been trading at a negative territory throughout October.

Investors could avoid substantial losses if they track the prices of the crack spread.

Related Articles

Tokyo Electric Power's Resuming Nuclear Plant

2023-12-28

|

Energy

|

Tags: LNG

Japan resumes its nuclear plant, lesser demand for LNG

Oil price outlook

2023-08-09

|

Energy

|

Tags: Crude Oil

|

Archived

The oil market is not just about the supply and demand of oil.

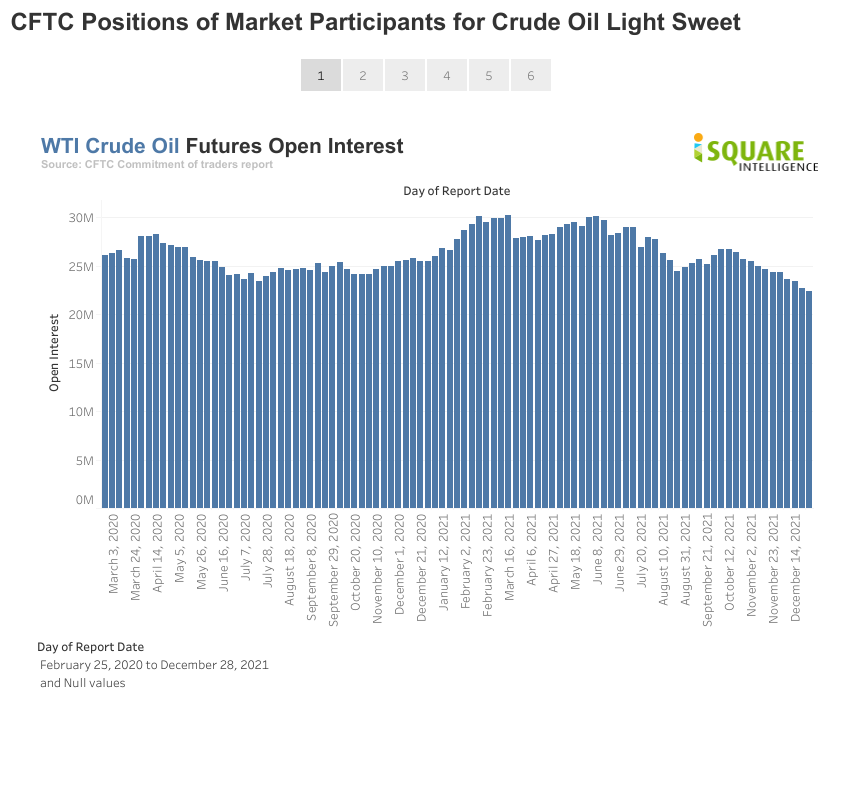

Divergence between oil price and open interest

2023-08-09

|

Energy

|

Tags: Crude Oil, Open Interest, Divergence

The price and volume of crude oil is not showing the same signal recently