Here's what we have for the week

Significant Event

- Bursa Malaysia is looking at imposing bumiputera equity

requirements for initial public offerings (IPOs) on the ACE Market.

Securities Commission Malaysia and Bursa Malaysia are considering changing

the listing guidelines to require new listings on the ACE Market to

allocate 12.5% of the enlarged share base to bumiputera investors approved

by the Ministry of Investment, Trade and Industry (Miti).Currently, the

growth-oriented ACE Market currently has no bumiputera equity requirements

at the point of listing.

- IOI Corp Bhd has allocated part of its aged plantation landbank

in Johor to build a solar power plant, in a move to venture into the

renewable energy sector.

- SD Guthrie Bhd, formerly known as Sime Darby Plantation, has

partnered with property developer AME Elite Consortium Bhd to develop a

green industrial park within the Johor-Singapore Special Economic Zone

(JS-SEZ). SD Guthrie announced that the park will be built on 641 acres of

its estate in Kulai, designed as a hub for high-value industries such as

logistics, advanced manufacturing, and clean technologies. AME Elite, a

developer specializing in industrial properties, has been collaborating

with various landowners to develop industrial parks, allowing for lower

capital requirements and faster project execution.

Real Estate Industry

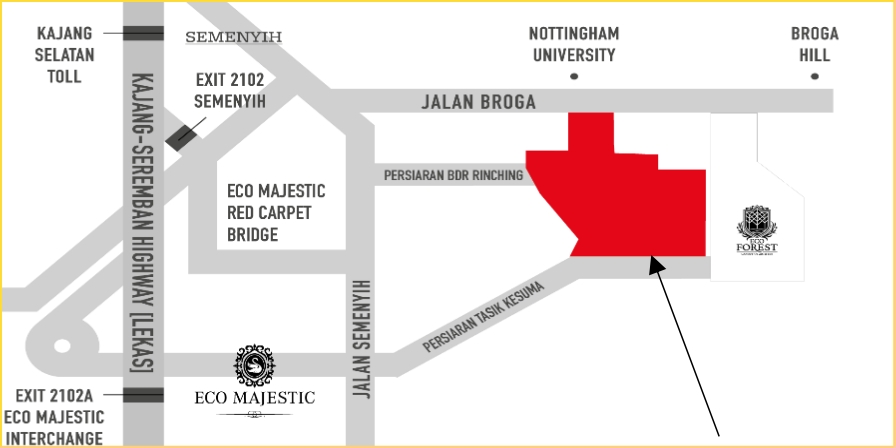

- Eco World Development Group is acquiring 847.25 acres of land

in Semenyih, Selangor, for RM742 million, which equates to RM20.12 per

square foot.

- Mah Sing Group is expanding its land bank by acquiring a 5.24-acre plot on Old Klang Road for RM113 million, or RM495 per square foot. Nearby, Kerjaya Prospek acquired land for RM300 per square foot in 2020 for its Bloomsvale project, reflecting a 65% increase in land prices over the past four years.

Infrastructure/Logistics

- The Malaysian federal government is conducting a feasibility

study for a new highway that would connect Simpang Pelangai in Pahang to

Putrajaya.

Cash Call/ Debt restructuring/Restructuring/Proposed Listing

- Pharmaniaga Bhd, the pharmaceutical company owned by the Armed

Forces Pension Fund, is revising its restructuring plan.

Privatization

- The major shareholder of Milux Corp, a household goods

manufacturer, has changed hands. The new majority shareholders are the Lim

brothers of Exsim Group. This is the third listed company the brothers

have acquired a majority stake in over the past three months. The other

two listed companies are Pan Malaysia Holdings Bhd, a hospitality company,

and WMG Holdings Bhd, a property developer based in Sabah.

Company Expansion Plan/ Capex Plan

- TMC Life Sciences Bhd is reviving the Thomson Iskandar medical

hub in JB. It will begin construction of its integrated medical hub,

Thomson Iskandar in Johor Bahru, by late 2025, with completion targeted

for 2030.

News we are reading

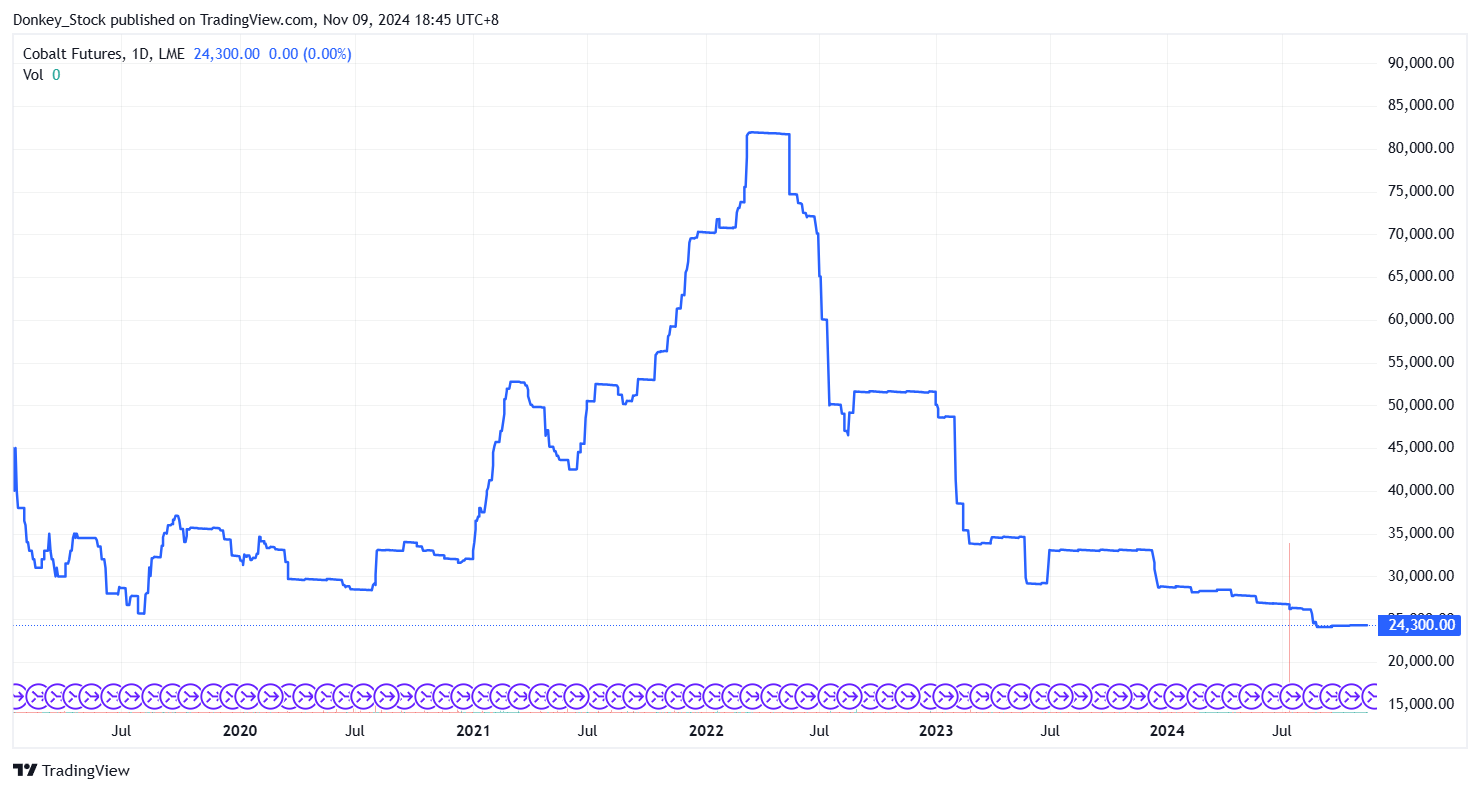

The price of cobalt is falling, primarily due to new supply and decreased demand. Lithium iron phosphate (LFP) batteries, which are cobalt-free rechargeable batteries, are becoming increasingly popular for electric vehicles (EVs). (Read More)