Newsletter 20241229

28 Dec, 2024

Category: Newsletter

Tags: Newsletter

New Medical Insurance Policies, Vision Valley Developments, and Relaxed Renewable Energy Rules

Here's what we have for the week

Significant Event

- Bank Negara Malaysia (BNM) has introduced interim measures to address the rising medical insurance premiums, including spreading out premium increases over at least three years and pausing certain premium adjustments for individuals aged 60 and above. These steps aim to alleviate the financial impact on policyholders and maintain medical and health insurance/takaful (MHIT) coverage. Additionally, BNM emphasized the need for broader measures to manage future premium adjustments and ensure the affordability of MHIT products.

- Bank Negara Malaysia (BNM) announced a RM60 million boost for healthcare reforms, including the rollout of a new payment model for private hospitals and the publication of common medical procedure costs for greater transparency. The funds will also support the development of a base medical and health insurance/takaful (MHIT) product to cover essential healthcare needs, and facilitate policyholders aged 60 and above to switch to this more affordable option.

- The Malaysian financial task force has proposed making the Rule of 78 method illegal for car loans. This method, which front-loads interest payments, disproportionately affects borrowers who repay early. The proposal aims to promote fairer lending practices and reduce household debt and bankruptcy risks.

Real Estate Industry

- KLCC (Holdings) Sdn Bhd is purchasing 486 acres of land, known as Bandar Malaysia, for an undisclosed amount. Rumours suggest they are paying RM 12 billion.

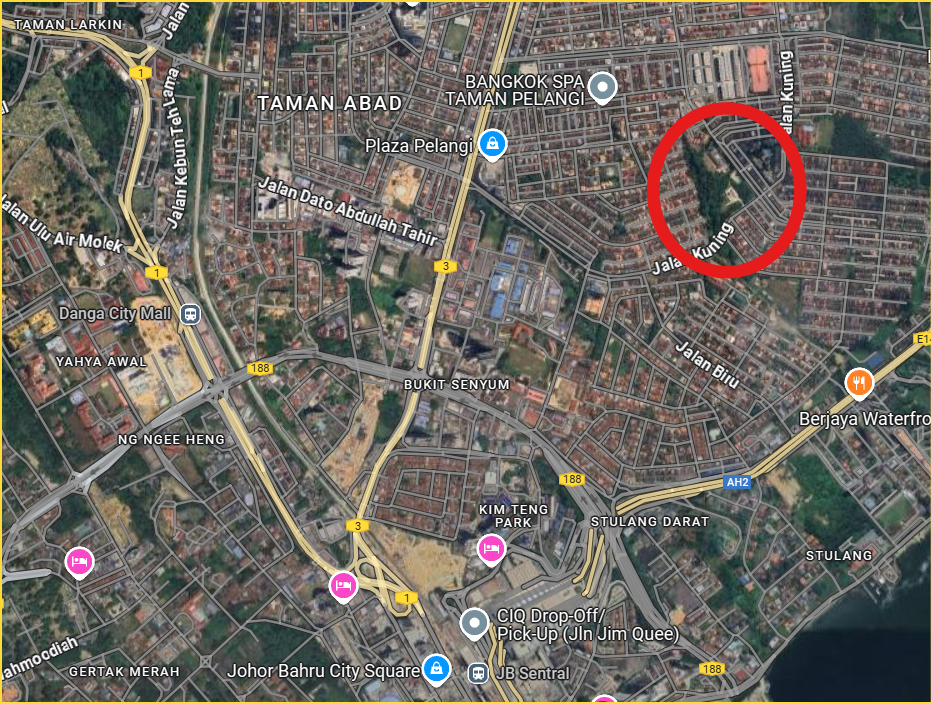

- Mah Sing Group is acquiring another piece of land in Johor, totalling 6 acres, for RM 156 million or RM 601 per square foot.

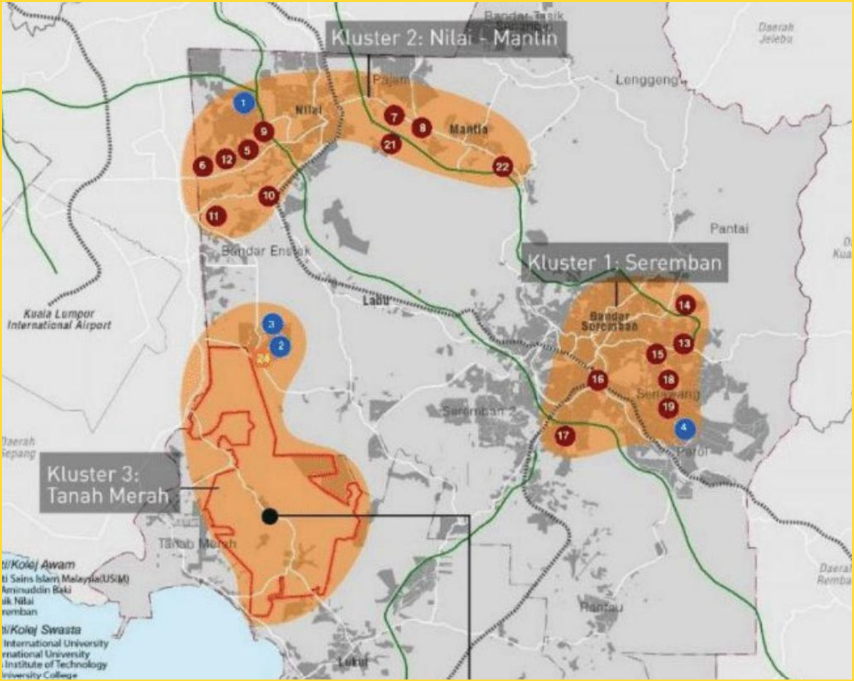

- SD Guthrie Bhd, Eco World Development Group Bhd, and NS Corporation will jointly develop a 1,166-acre industrial park in Bukit Pelanduk, Negeri Sembilan, with an estimated gross development value of RM2.95 billion. The project will be developed over eight years. SD Guthrie had partnered with TH Properties Sdn Bhd to develop Malaysia’s first halal-certified managed industrial park in Bukit Pelanduk in Aug 2024.

Infrastructure/Logistics

- The Ministry of Energy Transition and Water Transformation has removed the 85% demand capacity cap for non-domestic users under its self-consumption (SelCo) programme, and to allow the installation of solar panels on the ground and over bodies of water.

- Pengurusan Aset Air Bhd (PAAB) is set to invest nearly RM1 billion to fund the construction of two water treatment plants in Seberang Perai, Penang, starting in 2025.

Cash Call/ Debt restructuring/Restructuring/Proposed Listing

- Eramas Global Group Sdn Bhd will be injected into SCGM, the plastic packaging company, with RM207.94 million worth of shares at 36.5 sen each. SCGM became a cash company after selling its plastic packaging business to Mitsui & Co and FP Corp for RM544.38 million in 2022

Company Expansion Plan/ Capex Plan

- Singapore’s Wee Hur Holdings has signed a binding agreement to sell its portfoalio of seven purpose-built student accommodation (PBSA) assets, totalling over 5,500 beds across several Australian cities, to Greystar for A$1.6 billion. Although foreign student enrolment in Australia continues to grow, AUD 291,000 per room is still a significant price tag.

- Catcha Digital Bhd, founded by Patrick Grove (the founder of iProperty and iFlix), has been active recently. The company has acquired a digital media company focused on automotive content, a company that organizes consumer food expos, and a SaaS company specializing in lead management. All these companies are benefiting from Malaysia's economic upcycle.

What we are Thinking

SP Setia has sold a piece of land in Taman Pelangi to Mah Sing Group for RM 156 million, which translates to RM 601 per square foot or RM 26 million per acre. Mah Sing Group is confident about the potential of this land and projects sales proceeds from the development to reach RM 1.5 billion.

Johor Bahru's property prices are experiencing a parabolic rise and might continue their upward trend. Many people liken the relationship between Singapore and JB to the Hong Kong-Shenzhen model. However, from personal experience, the cross-border journey between Hong Kong and Shenzhen is not hassle-free, with many people rushing for limited moving capacity. This scenario raises concerns about whether Johor Bahru's property market will face similar challenges once the Rapid Transit System (RTS) Link becomes operational.

There is a possibility that property prices may peak when the RTS is fully operational. If the cross-border commute remains time-consuming and tiring, it could impact the appeal of high property prices in Johor Bahru. With the price gap between Johor and Singapore narrowing, potential buyers and investors need to consider whether the current market rates justify the hassle of crossing the border.

Related Articles

Newsletter 20241215

2024-12-14

|

Newsletter

|

Tags: Newsletter

China adopts a looser monetary policy , Axiata makes significant moves, Ah Huat Coffee begins cultivating its own coffee beans in Johor.

Newsletter 20241208

2024-12-13

|

Newsletter

|

Tags: Newsletter

Malaysia's Forex Market Liberalization, Feedmiller Cartel Fined, and Temasek Holdings Reduces U Mobile Stake

Newsletter 20241201

2024-12-01

|

Newsletter

|

Tags: Newsletter

Mega FPSO Company in the Making: Cheras Suburb Land Hits RM 809/sqft; Johor Invests RM 1.4 Billion in Water Treatment for Data Center Growth