Newsletter 20241201

1 Dec, 2024

Category: Newsletter

Tags: Newsletter

Mega FPSO Company in the Making: Cheras Suburb Land Hits RM 809/sqft; Johor Invests RM 1.4 Billion in Water Treatment for Data Center Growth

Here's what we have for the week

Significant Event

- RHB Bank Divesting its entire 99.95% stake in RHB Securities (Thailand) Public Company Ltd to Singapore-based stock brokerage firm Phillip Brokerage Pte Ltd for THB1,253.77 million (RM161.81 million)

- Malaysian seafood supplier Golden Fresh Sdn Bhd is sold to Affinity Equity Partner for RM 2 billion. Penang-based Golden Fresh, founded in 1989, makes products under the “Pacific West” brand.

- Bumi Armada Bhd is exploring a merger with MISC Bhd's offshore business. The prospective merger is expected to be an all-share transaction. For MISC, the merger will only involve its offshore business that owns, leases, operates and maintains offshore, floating, production, storage and offloading (FPSO) terminals. The largest shareholder of Bumi Armada, Ananda Krishnan, has recently passed away, while the largest shareholder of MISC is Petronas Malaysia.

Real Estate Industry

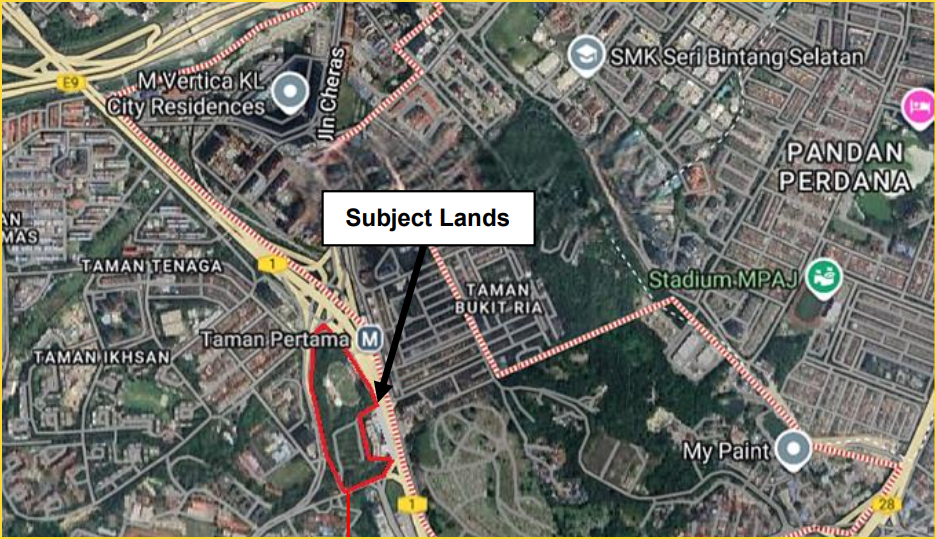

- Radium Development Bhd is acquiring a 13-acre piece of land at Taman Pertama MRT for RM 458 million, which translates to RM 809 per square foot. The Taman Pertama MRT station is just three stations from the TRX Station.

Location of land acquired by Radium Development

Infrastructure/Logistics

- Johor is set to develop four new Water Treatment Plants at an estimated cost of RM1.41 billion to address growing water demand from the state’s data centres.

Cash Call/ Debt restructuring/Restructuring/Proposed Listing

- Carlo Rino Group, a retailer for woman’s fashion, is selling its shares at 27 sen each in an initial public offering (IPO) that could raise over RM 46.4 million.

- JF Technology Bhd, a semiconductor manufacturer, plans to raise RM 46.35 million via a private placement to fund new investments and ongoing business expansion. The exercise involves the placement of up to 10% of its issued shares, totaling 92.71 million shares at RM 0.50 per share.

- Maxland Bhd, formerly a timber logging company, is issuing new shares representing 20% of its current share base to raise funds for its new ventures into bus assembly and the development of district cooling systems for industrial buildings. It plans to issue 320.73 million shares to investing companies at 4.55 sen each, totaling RM 14.59 million in cash.

- Trive Property Group Berhad has proposed a share capital reduction to wipe out RM 85 million of the company’s accumulated losses.

- Jati Tinggi Group Bhd, a company involved in infrastructure utilities engineering solutions, plans to raise RM 14.1 million via a private placement to fund new projects. The cash call involves the issuance of up to 39.18 million new shares at RM 0.36 per share.

- MCE Holdings Bhd, an auto parts manufacturer, plans to raise up to RM 26.5 million through a private placement of shares to partially finance a new manufacturing factory in Serendah and other secured projects. The placement will involve up to 18.53 million shares at RM 1.43 per share.

Privatization

- Mercury Industries, an automotive paint manufacturer, has received an unconditional mandatory takeover offer at 90 sen per share from Datuk Doh Tee Leong, a major shareholder of Lagenda Properties Bhd and Epicon Bhd

Company Expansion Plan/ Capex Plan

- Hextar Industries has secured exclusive rights to develop, open, and operate coffee shops under the Luckin Coffee brand across Malaysia for a period of 10 years.

- LBS Bina Group is exploring the development of a 10-gigawatt (GW) green hydrogen plant in Kota Marudu, Sabah.

News we are reading

- China will reduce the export tax rebate rate for certain refined oil products, photovoltaics, batteries, and some non-metallic mineral products from 13% to 9%. Additionally, it will cancel the rebate for aluminum and copper products, as well as chemically modified oils and fats from animal, plant, or microbial sources. As a result, companies manufacturing these items may face reduced competition from their Chinese counterparts. (Read More)

- Russia is restricting uranium exports to the United States, which relies on Russia for 23% of its uranium supply. As a result, Cameco, Canada's largest uranium producer, may benefit from this situation. (Read More)

Related Articles

Newsletter 20241229

2024-12-28

|

Newsletter

|

Tags: Newsletter

New Medical Insurance Policies, Vision Valley Developments, and Relaxed Renewable Energy Rules

Newsletter 20241215

2024-12-14

|

Newsletter

|

Tags: Newsletter

China adopts a looser monetary policy , Axiata makes significant moves, Ah Huat Coffee begins cultivating its own coffee beans in Johor.

Newsletter 20241208

2024-12-13

|

Newsletter

|

Tags: Newsletter

Malaysia's Forex Market Liberalization, Feedmiller Cartel Fined, and Temasek Holdings Reduces U Mobile Stake