Newsletter 20240818

18 Aug, 2024

Category: Newsletter

Tags: Newsletter

Brighter outlook for Malaysia GDP and Ringgit Malaysia. Malaysia to experience the 1990s growth again

Significant Event

Six government-linked investment companies

(GLICs) have committed to investing RM120 billion in domestic direct

investments (DDI) over the next five years under a programme led by the

Ministry of Finance (MoF). The six GLICs involved are Khazanah Nasional Bhd

(Khazanah), the Employees Provident Fund (EPF), Kumpulan Wang Persaraan

(Diperbadankan) [KWAP], Permodalan Nasional Berhad (PNB), Lembaga Tabung Haji

(TH), and Lembaga Tabung Angkatan Tentera (LTAT).

Khazanah will focus on increasing productivity, while KWAP will concentrate on private equity, infrastructure, real estate, food security, the digital economy, energy transition, and advanced manufacturing. EPF will prioritize healthcare solutions, and PNB will focus on developing new industrial parks, supporting automation and smart farming in palm oil, and investing in green and energy transition assets. TH will focus on Islamic finance instruments, and LTAT will target the pharmaceutical industry.

Real Estate Industry

- Sunway Reit is acquiring Kluang Mall for RM 158 million. Kluang

Mall has a net lettable area of 360,000 square feet.

Infrastructure/Logistics

- The Science, Technology and Innovation Ministry will build the

first solid-state hydrogen reactor for sustainable electricity generation

in Tanjung Malim, Perak.

- Singapore Airlines’ low-cost carrier Scoot will launch the

Singapore- Melaka route in October 2024.

- Perak Transit Berhad has received the Certificate of Completion

and Compliance for the Bidor Sentral.

Cash Call/ Debt restructuring/Restructuring/Proposed Listing

- Straits Energy Resources Bhd is planning to list its oil trading and bunkering arm on the New York Stock Exchange.

Company Expansion Plan/ Capex Plan

- Maxis Bhd and Huawei Technologies (Malaysia) Sdn Bhd have announced a strategic partnership to establish a joint innovation centre focused on developing 5G-advanced technology.

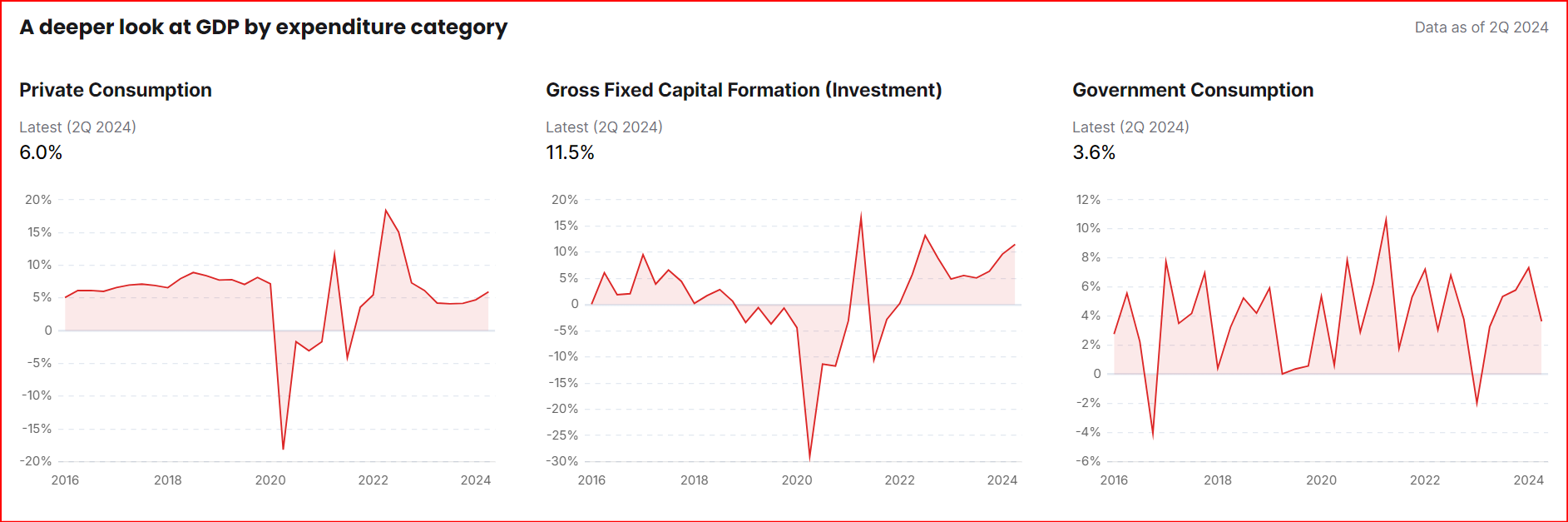

Maybank Investment Bank Bhd (Maybank IB) believes that Malaysia is currently experiencing its third investment upcycle. The previous two upcycles saw the share of gross fixed capital formation in GDP surge from 22.1% in 1987 to 49.2% in 1997, and from 21.7% in 2009 to 26.6% in 2013.

The rising momentum in investment realization is evident from the surge in imports of capital goods, particularly machinery and transport equipment, as well as the acceleration in banking system loan growth for industrial buildings, factories, land, construction, and working capital.

This investment upcycle reflects the benefits of political stability following the 15th general election (GE15), driven by five key themes: the green economy, technology, the Johor-Singapore Special Economic Zones (JS-SEZ), infrastructure, and government-linked firms.

Historically, investment upcycles have led to sustained multi-year GDP growth, double-digit growth in construction, and above-trend consumer spending. Inflation and the ringgit also trended upward during these periods.

Don't

miss out on this wave.

Related Articles

Newsletter 20241229

2024-12-28

|

Newsletter

|

Tags: Newsletter

New Medical Insurance Policies, Vision Valley Developments, and Relaxed Renewable Energy Rules

Newsletter 20241215

2024-12-14

|

Newsletter

|

Tags: Newsletter

China adopts a looser monetary policy , Axiata makes significant moves, Ah Huat Coffee begins cultivating its own coffee beans in Johor.

Newsletter 20241208

2024-12-13

|

Newsletter

|

Tags: Newsletter

Malaysia's Forex Market Liberalization, Feedmiller Cartel Fined, and Temasek Holdings Reduces U Mobile Stake