Here's what we have for the week

- YTL Cement Bhd is buying an 81.34% stake in Singapore-listed NSL Ltd for S$227.61 million, or S$75 cents per share. NSL is involved in manufacturing building materials.

- Hibiscus Petroleum Bhd has been awarded a 65% participating interest (PI) and operatorship in a production sharing contract (PSC) by Petroliam Nasional Bhd (Petronas). The effective date of the PSC is July 1, 2024, with a contract duration of 24 years.

*New Oil Field awarded to Hibiscus Petroleum

- IOI Properties Group is acquiring Tropicana Gardens Mall in Petaling Jaya, Selangor from Tropicana Corp Bhd for RM 680 million.

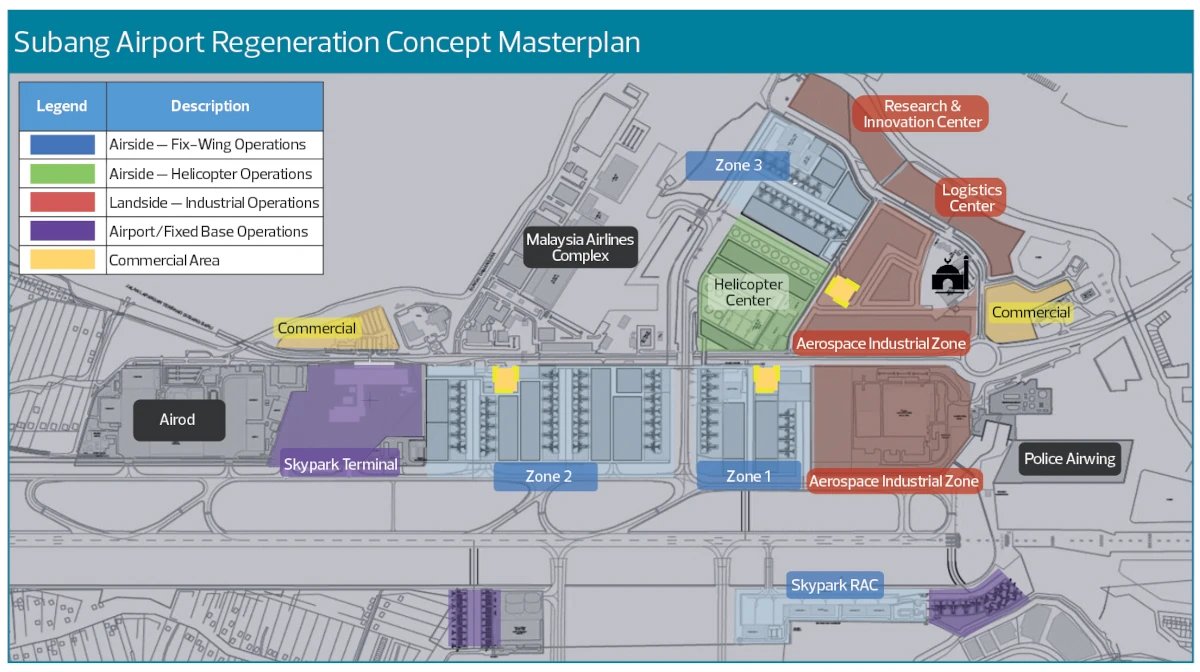

- Subang Airport will be expanded and its surrounding 1,179.5 acres will be developed, catering to aerospace manufacturers, assemblers and component maintenance, repair and operations (MRO) operators.

What we are thinking

Two of Malaysia's largest steel manufacturing players, Ann Joo and Malayan Steel, are raising funds by issuing new shares to support their business expansion and project expenditure.

Malaysia’s steel consumption, as measured by apparent steel consumption (ASC), fell 26% to 6.8 million tonnes in 2020, from 9.2 million tonnes in 2019, before climbing to 7 million tonnes in 2021, 7.5 million tonnes in 2022 and 7.9 million tonnes in 2023 amid steady recovery in the construction sector.

With the data centre boom and the chip industry expansion, we might see the beginning of an upcycle in the steel industry in the coming months.

Cash Call/ Debt restructuring/Restructuring/Proposed Listing

- Nationgate Holdings Bhd, whose share price surge after being one of the supplier of NVidia H-100 AI server, intends to issue new shares to raise RM429.3 million via the placement of 207.39 million shares at RM 2.07 per share. In February, it was reported that the H100 was selling at over US$40,000, but there have been some reports that the chip was selling for US$309,000 just a few months later.

- Malaysian Genomics Resource Centre Bhd has proposed to undertake a private placement that is expected to raise up to RM4.98 million via the issuance of 13.72 million new shares at an issue price of RM 36.3 sen per placement share.

Company Expansion Plan/ Capex Plan

- Grand Central Enterprises Bhd, the owner of Grand Continental Hotels has received a privatisation offer from its controlling shareholder at RM 46 sen per share.