Newsletter 20240721

21 Jul, 2024

Category: Newsletter

Tags: Newsletter

ExxonMobil Divestment, New Business Streams for Construction Players, and More Opportunities for Malaysian Renewable Energy Companies

Here's what we have for the week

- ExxonMobil Corp is selling its upstream oil and gas assets to Petronas, exiting Malaysia’s upstream sector. ExxonMobil operates 35 O&G platforms in 12 fields offshore Terengganu and has a working interest in another 10 platforms in 5 fields in the South China Sea. The combined operations produce about 15% of Malaysia's crude oil and condensate, totaling 600,000 barrels a day, and more than half of the peninsula's natural gas, exceeding 2 billion cubic feet per day.

- German insurer Allianz is planning to buy a majority stake in Singapore's Income Insurance for about US$1.6 billion, or S$40.58 per share, for a total transaction value of S$2.2 billion.

- Construction giant Gamuda Bhd has secured the contract to deliver a rail network in Perth, Australia, through its joint venture with Alstom SA.

Real Estate Industry

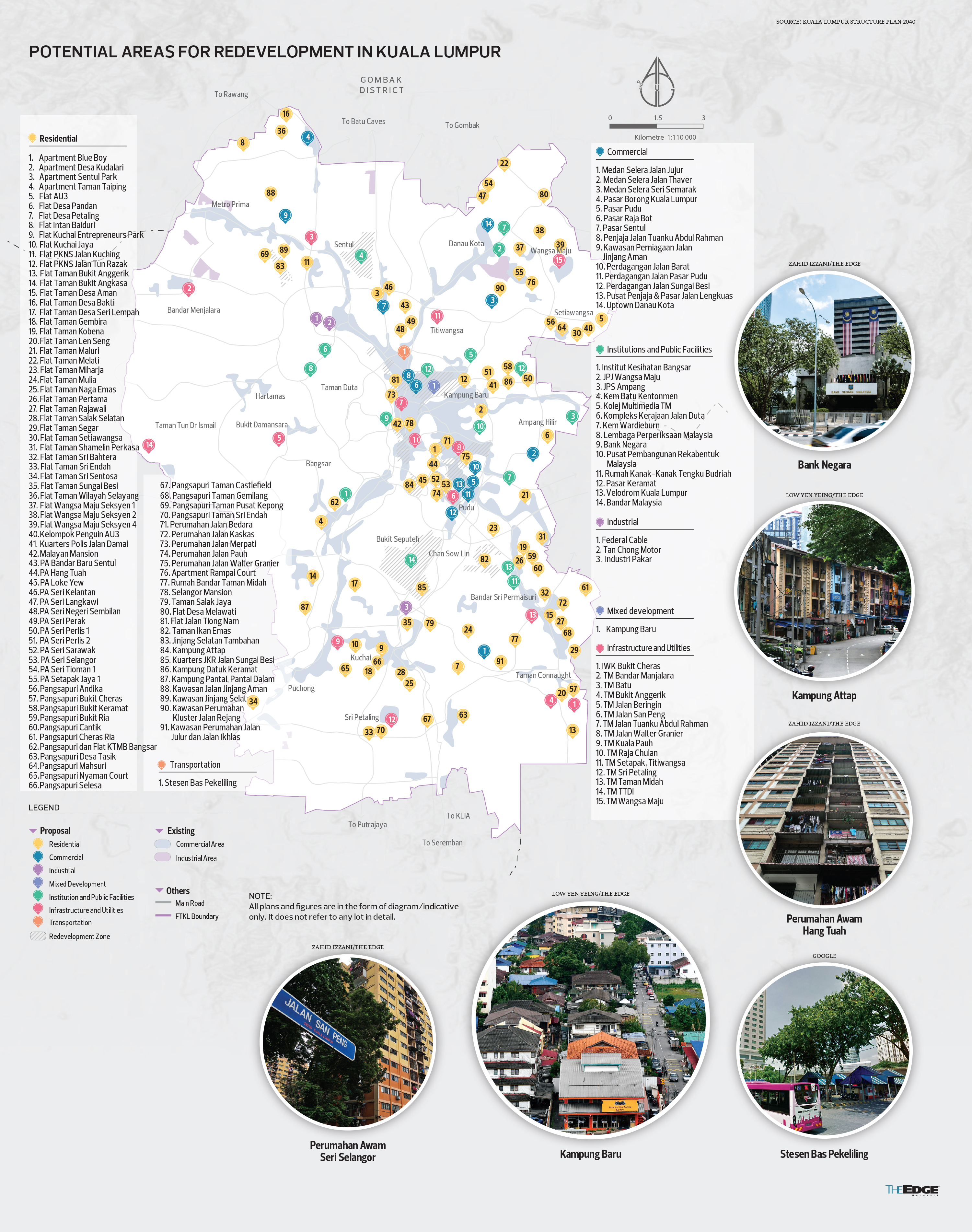

The Malaysian government suggested reducing the threshold for 'en bloc sales' from 100% to 75%. Kuala Lumpur City Hall (DBKL) has identified a total of 139 sites, with a combined area of 1,297 hectares, for redevelopment. Here are the sites identified by DBKL:

- The first phase of Sungai Bagan Industrialised Building System (IBS) Industrial Park, Kelantan, spanning over 80 hectares here, is expected to be fully completed by March 2025. This could lower construction cost in Kelantan.

Cash Call/ Debt restructuring/Restructuring/Proposed Listing

- The shareholding structure between Thai Beverage, Fraser & Neave Ltd (F&N) and Frasers Property has been reorganized to clarify relationships and focus on a single sector.

- Beer Chain Helens International has lodged its secondary listing on the SGX

- UMS Holdings Ltd, a company involved in semiconductor equipment manufacturing, is proposing a secondary listing on the main market of Malaysia’s stock exchange Bursa Malaysia.

Company Expansion Plan/ Capex Plan

- Yangzijiang Shipbuilding is expanding its ship manufacturing base in Jiangsu Province, China.

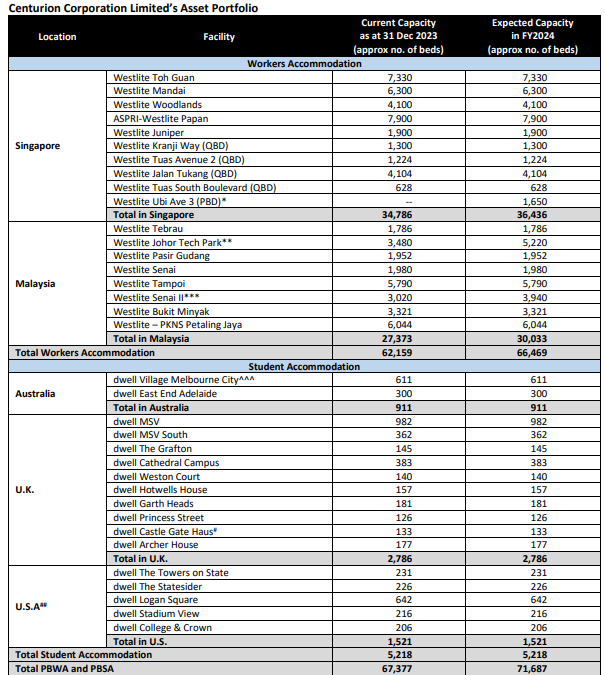

- Advancecon Holdings Bhd and MyEG Bhd are announcing their plan to venture into the business of operating centralized labor quarters. One of the key players in the market is Centurion Corp, and its share price has been performing very well.

Market Insights

- Palm oil export for July is great. (Read More)

News we are reading

- The deal for Singapore to import hydropower from Laos is stuck due to disagreements over how the energy will be transmitted through Malaysia and Thailand. This could bode well for Malaysia renewable energy producer as Singapore has set a target of importing 4 gigawatts (GW) of low carbon power by 2035. (The Edge)

What we are thinking

Petroliam Nasional Bhd (Petronas) stated its obligations to oil-producing states. Petronas will only make a cash payment of 5% to state government if petroleum is discovered and extracted within the state. The Petroleum Development Act (PDA) will be read alongside the Territorial Sea Act 2012 [Act 750] (TSA), which defines the state's territorial sea up to 3 nautical miles from the low tide line. Therefore, if no petroleum is found and obtained within the state’s territorial sea boundary of up to 3 nautical miles, Petronas is not obligated to make any cash payment based on the PDA and TSA.

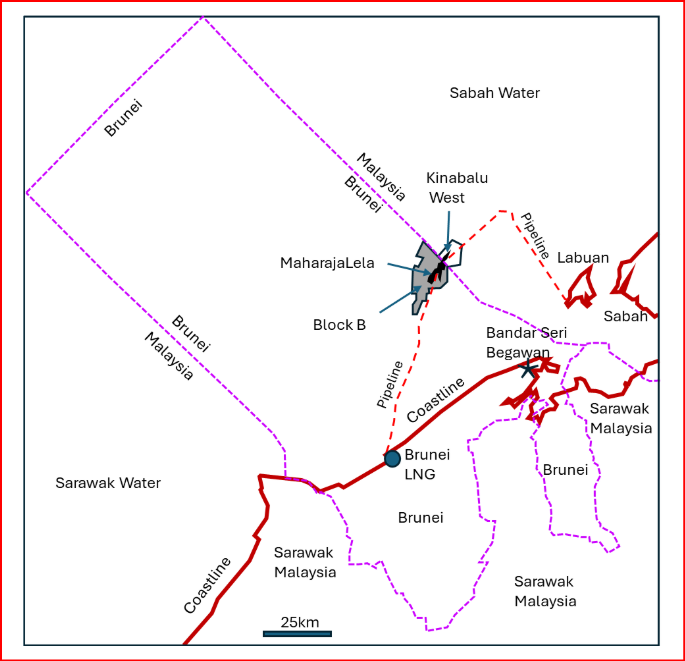

Over the last few months, oil majors are selling their cash cows due to carbon neutrality requirements. ExxonMobil is selling its Malaysian oil field assets, Total Energies is selling its Brunei oil field assets, and Shell is selling its refineries in Singapore. This could be a good opportunity for local players to take advantage of.

Related Articles

Newsletter 20241229

2024-12-28

|

Newsletter

|

Tags: Newsletter

New Medical Insurance Policies, Vision Valley Developments, and Relaxed Renewable Energy Rules

Newsletter 20241215

2024-12-14

|

Newsletter

|

Tags: Newsletter

China adopts a looser monetary policy , Axiata makes significant moves, Ah Huat Coffee begins cultivating its own coffee beans in Johor.

Newsletter 20241208

2024-12-13

|

Newsletter

|

Tags: Newsletter

Malaysia's Forex Market Liberalization, Feedmiller Cartel Fined, and Temasek Holdings Reduces U Mobile Stake