Just use this chart to forecast the price of banking stocks

17 Jan, 2022

Category: Banks

Tags: Portfolio

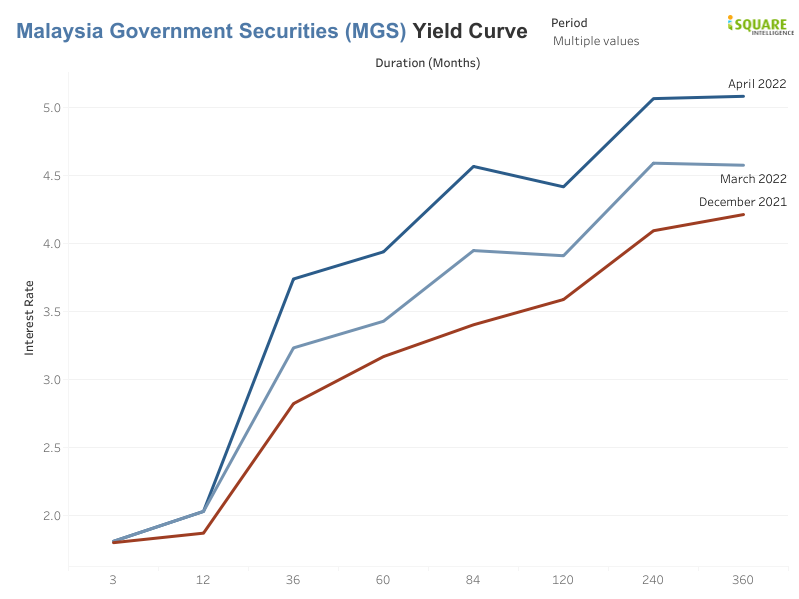

A useful tool to forecast the profitability of banking stocks

Related Articles

The real reason for sluggish bank share price

2023-08-09

|

Banks

|

Tags: Interest Rate

|

Private

Competition from Digital Banks is minimal, the hike in interest rate is the true factor

Fears are starting to grow in the banking industry?

2023-08-09

|

Banks

|

Tags: Portfolio

|

Private

The share price of banks is not catching up with bond yields

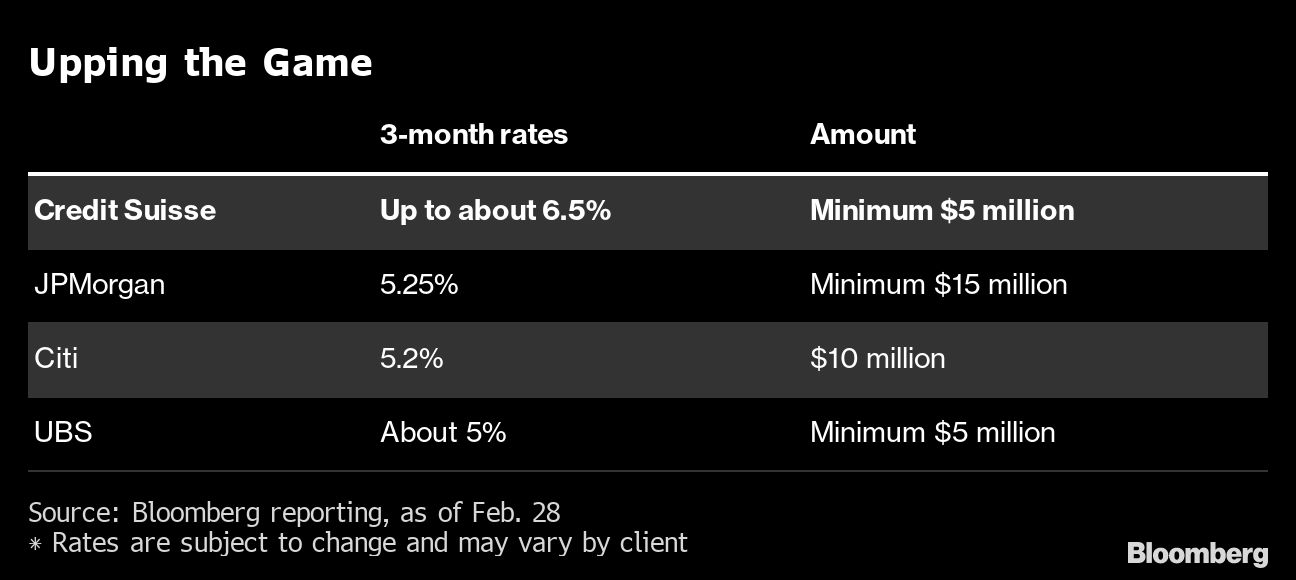

Credit Suisse brink of collapse

2023-08-09

|

Banks

|

Tags: Credit Suisse

|

Private

redit Suisse is offering deposit rates as high as 6.5% for new money to win back clients, which may indicate a higher level of non-performing loans or credit risk.