The real reason for sluggish bank share price

6 May, 2022

Category: Banks

Tags: Interest Rate

Competition from Digital Banks is minimal, the hike in interest rate is the true factor

Related Articles

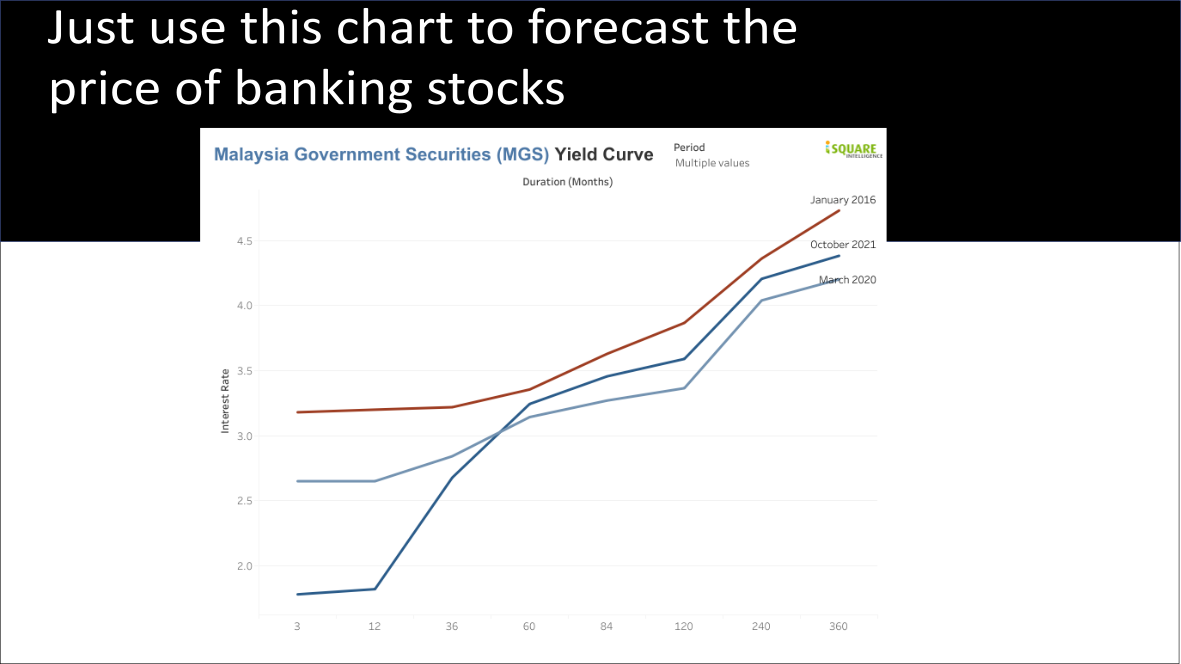

Just use this chart to forecast the price of banking stocks

2023-08-09

|

Banks

|

Tags: Portfolio

|

Private

A useful tool to forecast the profitability of banking stocks

Fears are starting to grow in the banking industry?

2023-08-09

|

Banks

|

Tags: Portfolio

|

Private

The share price of banks is not catching up with bond yields

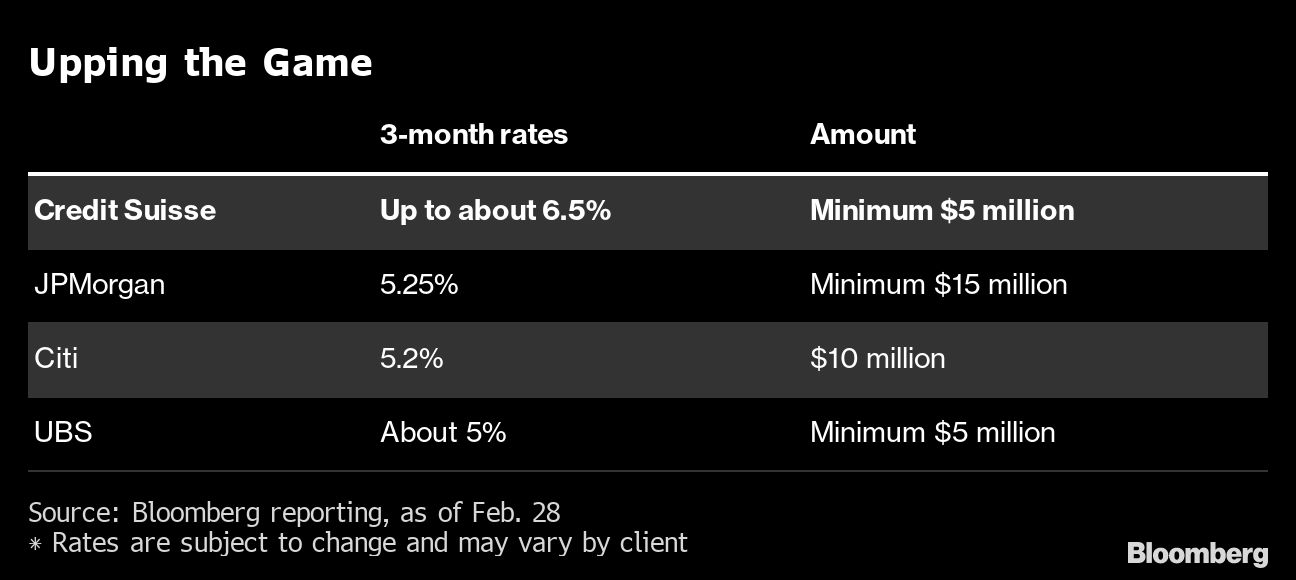

Credit Suisse brink of collapse

2023-08-09

|

Banks

|

Tags: Credit Suisse

|

Private

redit Suisse is offering deposit rates as high as 6.5% for new money to win back clients, which may indicate a higher level of non-performing loans or credit risk.