Key Points from Dialog quarter report Mar'24

23 May, 2024

Category: Company

Tags: Dialog

Key Points from Dialog quarter report

Key Points from Dialog quarter report

• Higher profit from increased production in upstream activities.

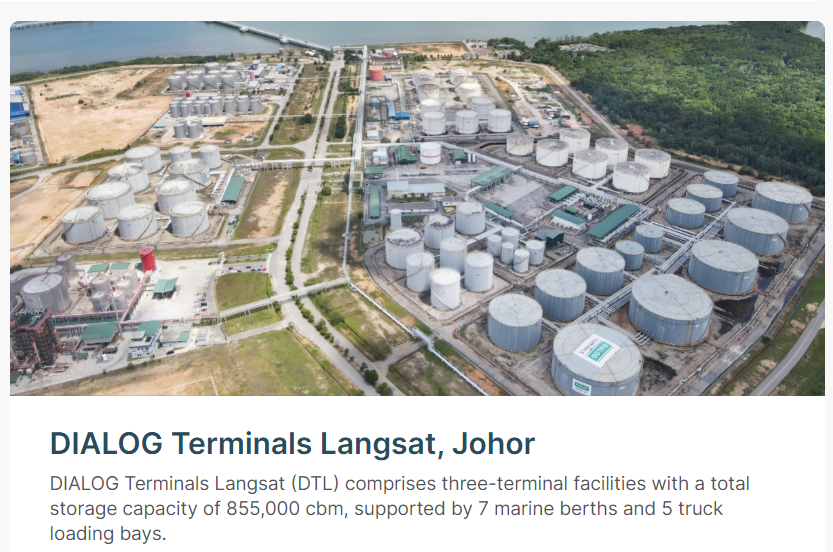

• Stable revenue from operating Terminals Langsat and Terminal Pengerang 5.

• Higher profit due to increased tank storage occupancy rates.

• EPCC and plant maintenance projects reported losses.

• Increased activities at Jubail Supply Base, Saudi Arabia led to higher revenue and profit.

• Terminal business currently has an operating capacity of 5.1 million m³.

• Associate company Morimatsu Dialog is expanding its fabrication facilities.

• Building a specialty chemical plant producing malic acid at BASF Petronas Chemical Complex in Gebeng, Kuantan.

• Venturing into storage facilities for renewable fuel products at Terminal Langsat 3.

My Opinion:

• EPCC Profit Potential: The EPCC segment is expected to turn profitable once Dialog renegotiates new contracts. Many existing contracts were signed during the low oil price era, resulting in low margins.

• Pengerang Land Bank: Dialog has a vast land bank in Pengerang, which could benefit from chemical companies relocating from Singapore to Johor.

• Strong Management: The management is handling operations well and has clear growth prospects.

Overall, it's a solid company with a promising future. Just my 2 cents.

Related Articles

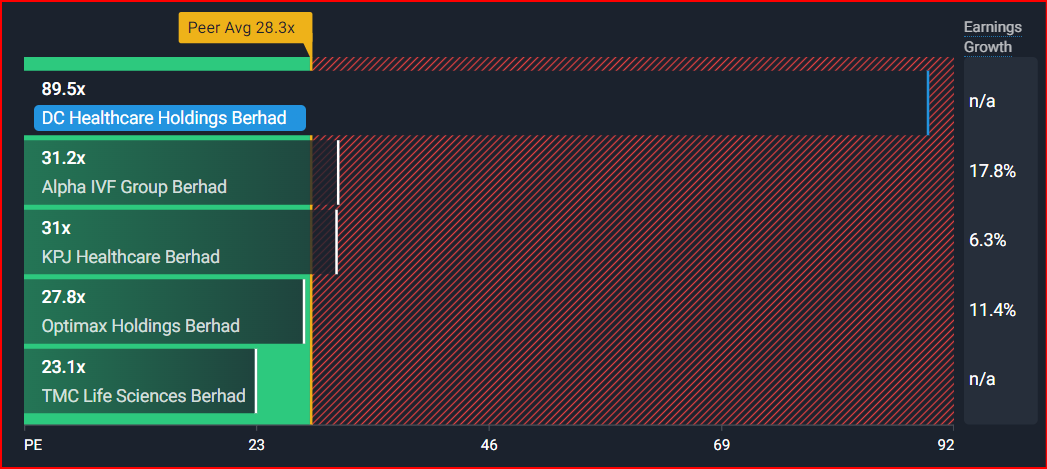

DC Healthcare Quarter Snapshot

2024-06-11

|

Company

|

Tags: DC Healthcare

The worsening financial status of DC Healthcare Bhd