DC Healthcare Quarter Snapshot

27 May, 2024

Category: Company

Tags: DC Healthcare

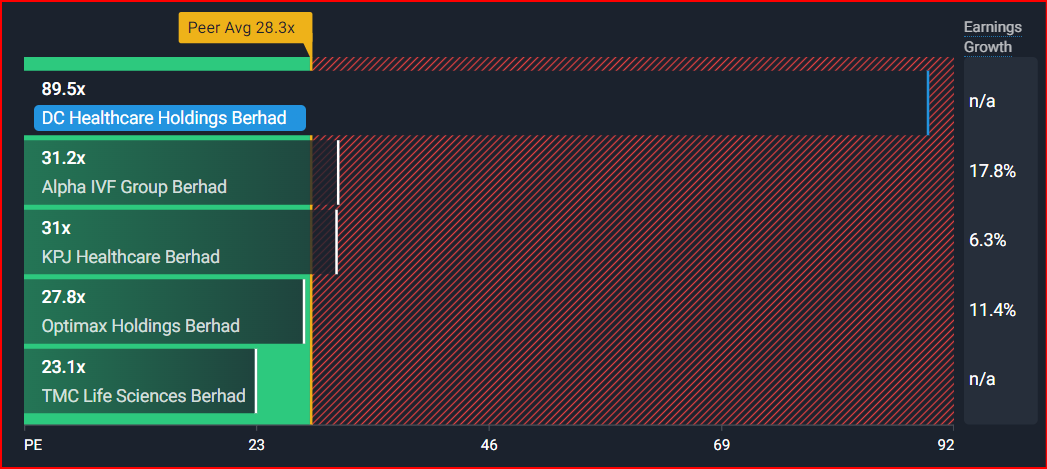

The worsening financial status of DC Healthcare Bhd

DC Healthcare Bhd, a company that went public last year, experienced an impressive 59-fold oversubscription during its initial public offering (IPO).

However, the recent financial results paint a different picture.

Revenue has nearly halved, while losses have surged by 28 times.

Additionally, the operating cash flow is turning negative.

Despite having no debt, the company’s net asset value stands at RM 0.06 per share. Some might argue that it’s an asset-light company, but the absence of positive cash flow raises concerns.

Similarly, owning a loss-making property makes it challenging to sell at market price. The critical question remains: Will a loss-making company’s share price eventually trade below its net asset value? Only time will reveal the answer.

Related Articles

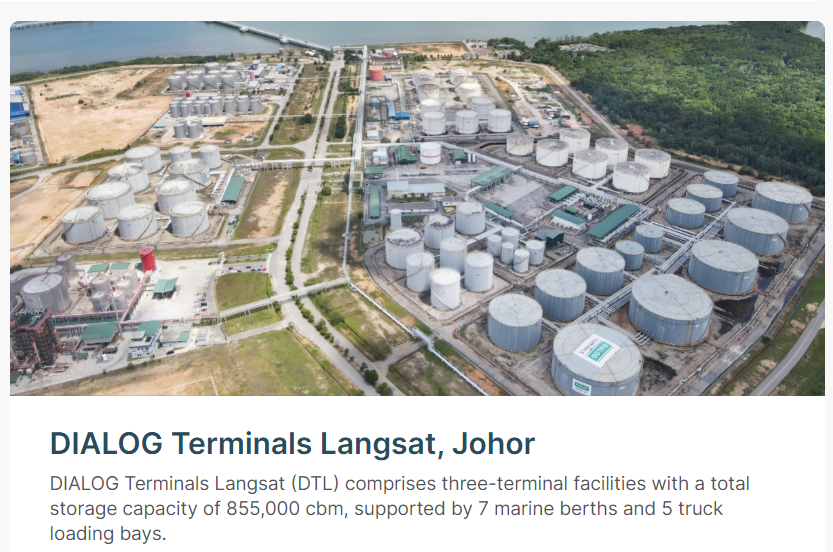

Key Points from Dialog quarter report Mar'24

2024-05-23

|

Company

|

Tags: Dialog

Key Points from Dialog quarter report