Why JPY Falls after raising Interest Rate

28 Mar, 2024

Category: Currency

Tags: JPY

JPY reaching 1990 low after raising the interest rate

Quite a number of friends ask me why the Japanese Yen falls

after Japan decides to increase its interest rates? Let me break it down for you:

So, Japan decides to hike up its interest rates, right? But

then, the very next day, the Swiss National Bank goes and announces that

they're lowering their interest rates. And to add to the mix, the UK comes

along and says that their Consumer Price Index (CPI) isn't as high as everyone

thought it would be.

Now, when all this happens, people start thinking that the

US Dollar is going to be stronger compared to the currencies in Europe. They

figure Europe might lower its interest rates sooner than the US does. So, what

do they do? They start grabbing up US Dollars, making US Dollar to move stronger

than all the currencies.

Also, before Japan officially announces the interest rate

hike, the market already expects it to happen. Higher inflation and salary increase

already push Japanese Yen higher. So, the Yen had already adjusted for it. When

the news finally hits, traders are taking profit.

Hope that clears things up a bit for you!

Related Articles

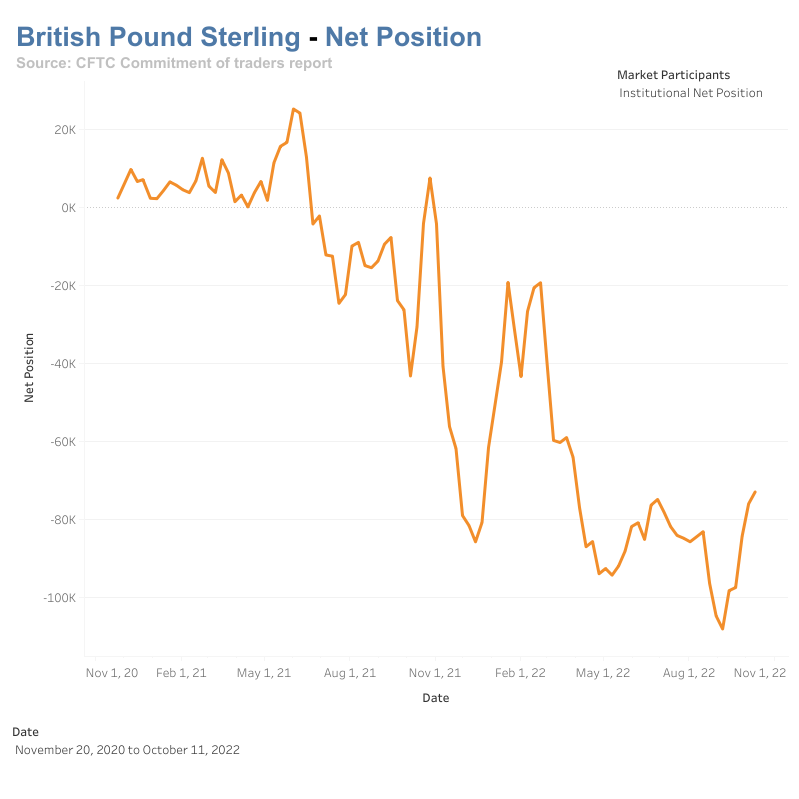

Futures Position of GBP

2023-08-09

|

Currency

|

Tags: GBP

|

Private

The net position of institutional funds on USD/GBP

Positions of different market participants for EUR/USD

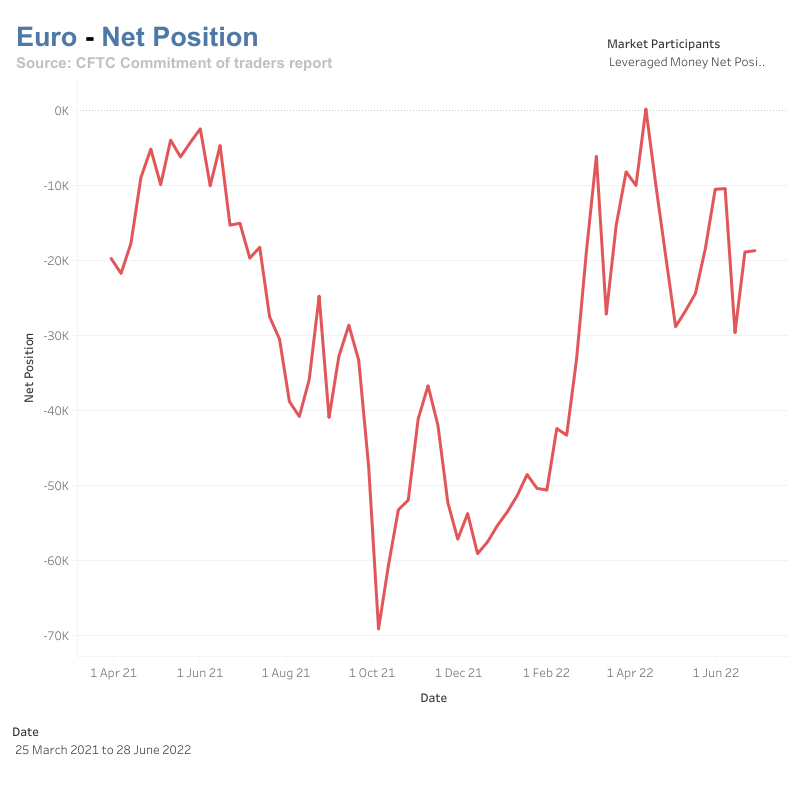

2023-08-09

|

Currency

|

Tags: EUR, USD

|

Private

A check on hedge funds' position when EUR/USD is trading at parity.

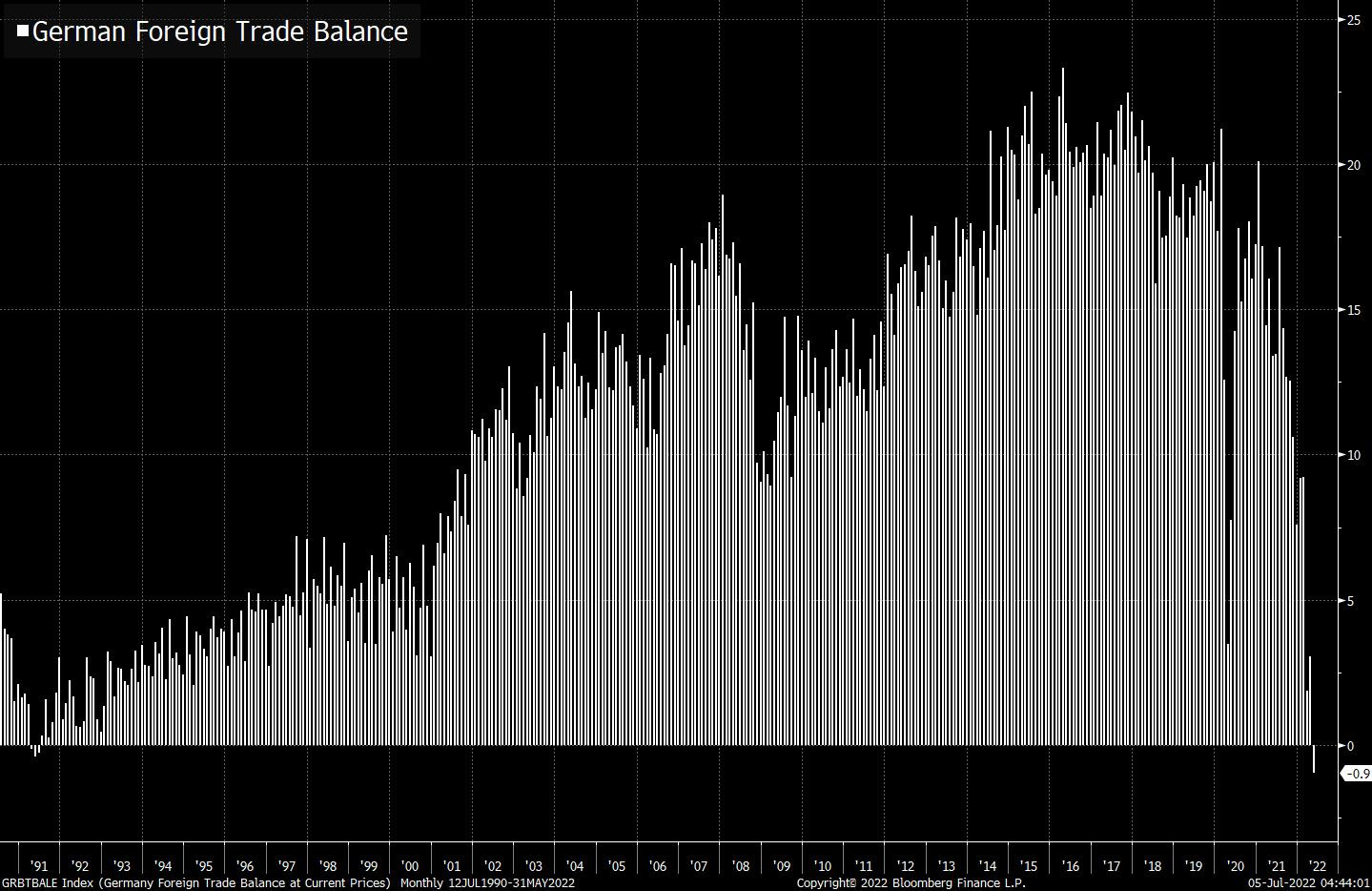

Major movements in the currency market

2023-08-09

|

Currency

|

Tags: EUR, JPY, KRW

|

Private

The market is volatile and opportunities arise.