On the run Treasuries and off the run Treasuries

A spread that breaks the financial system in the year 1998

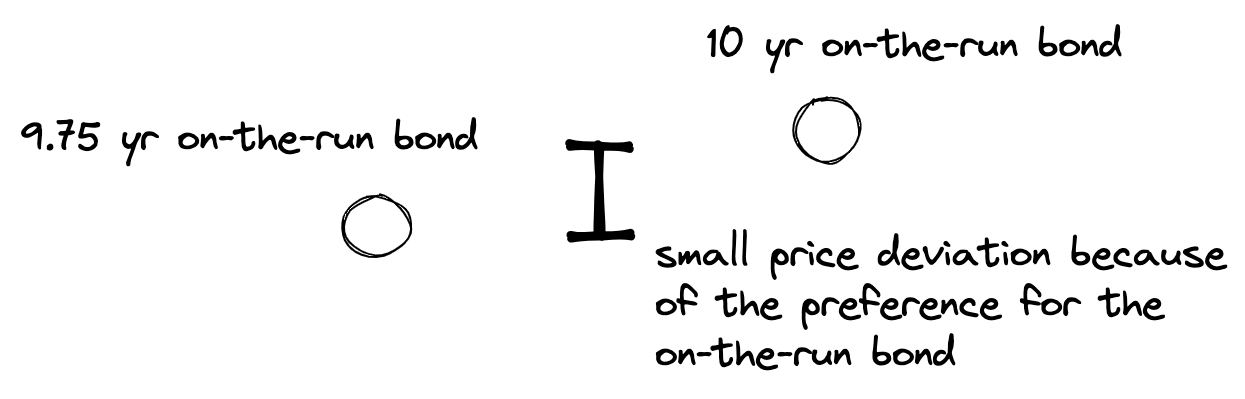

On-the-run Treasuries are the most

currently issued Treasury bonds or notes.

It is the most commonly traded form of a

Treasury note of a specific maturity. The on-the-run Treasury is significantly

more liquid than other forms of securities. Therefore, they tend to trade at a

premium.

Off-the-run Treasuries refer to debt instruments

issued by the US Treasury that are not the latest offering.

Long Term Capital Management (LTCM), a hedge

fund that was making its profit by trading this spread was incredibly

successful before it imploded and almost took down the financial system along

with it.

There are opportunities for arbitrage in the

market, but don't average down when the market direction is against you. You

may be right eventually but your position may go bust before the market reverts

back to its normalcy.