Capital Structure of O&G Industry segments

Segments with lower debt are relatively safer investments

The oil price has been hovering around USD 80 per barrel, not too high and not too low. Just nice for oil producers to increase their production capacity.

The US buying back oil for the Strategic Petroleum Reserve also creates a strong demand for crude oil.

In fact, the oil & gas industry perform greatly on Bursa Malaysia in 2022. However, there are many segments in this industry.

Picking the segment with relatively low debt is a safer choice for me as I believe the USD interest rate will keep high for quite some time.

Segment with low debt to equity ratio are: Floaters, plant turnaround, Hook-Up and Commissioning & Maintenance, Construction and Modification, Offshore Installation

Segment with High Debt to equity ratio are: Offshore Fabrication, Marine Vessels, Drilling Rigs and Hydraulic Workover Units, Linepipes

In short, service providers usually have lower debt while asset owners who earn an income via leasing their assets usually have higher debt level.

Related Guides

Uranium Overview

2022-01-13

|

Energy

|

Tags: Uranium

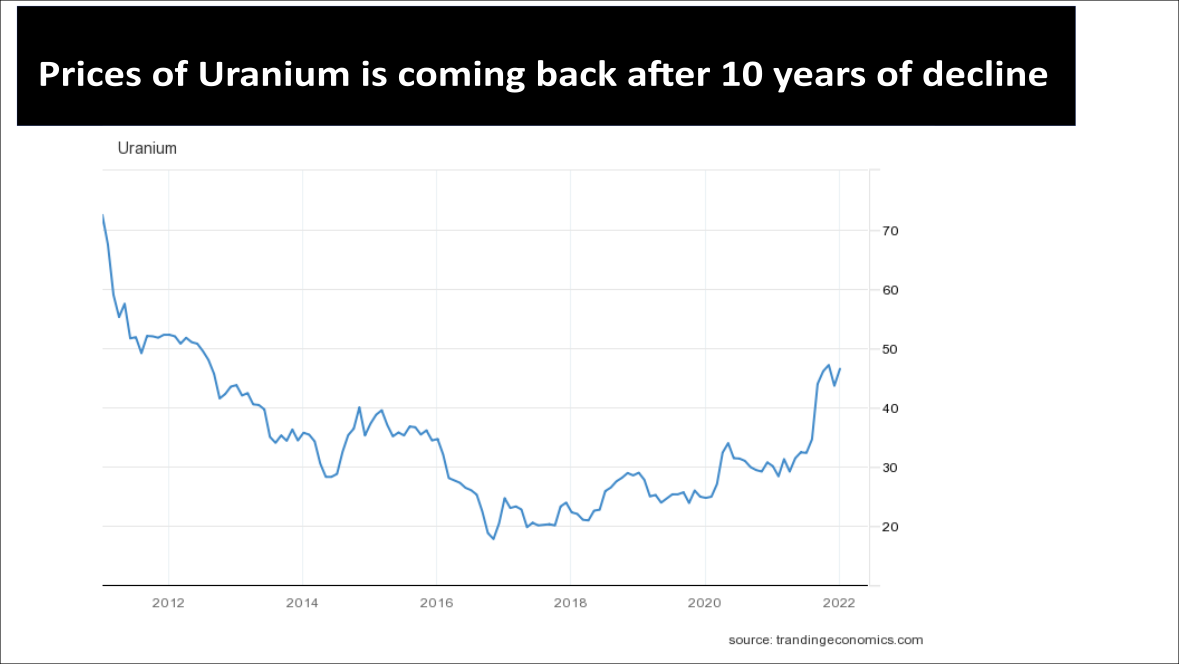

The European Commission has proposed plans to label nuclear power as green on 2 Jan 2022. This may be the start of a reversal in Uranium demand.