Malaysia Bank Loan Portfolio

26 Dec, 2024

Category: Bank

Tags: Bank

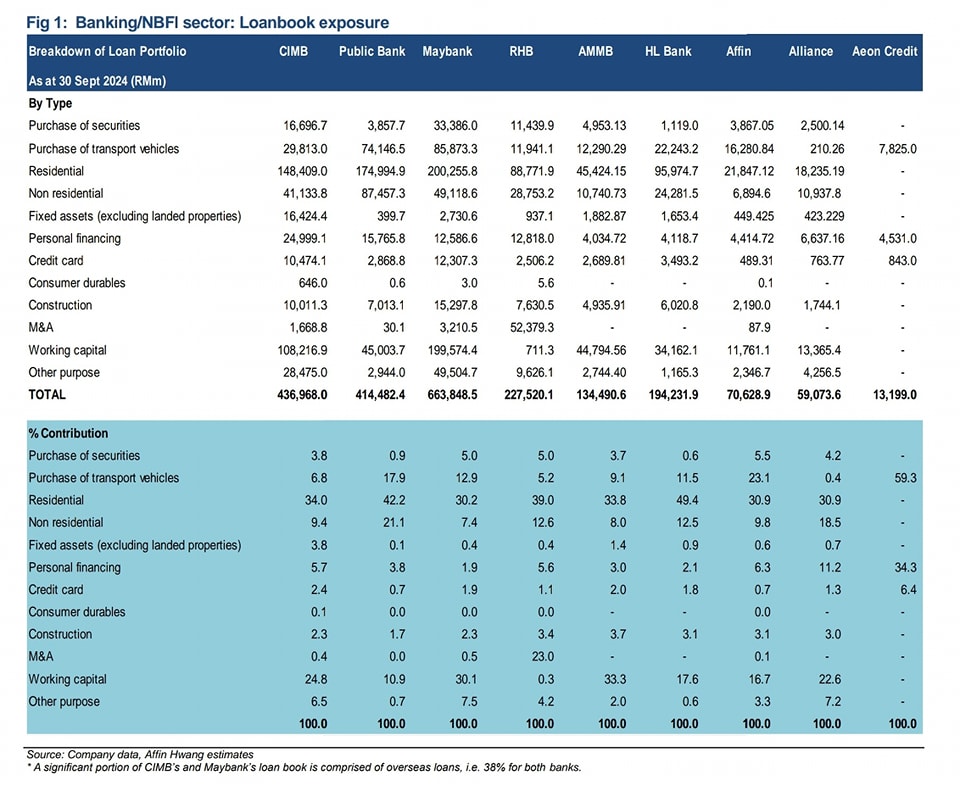

The loans disbursed by bank by categories

Loan Offerings by Malaysian Banks

Malaysian banks display varying focuses in their loan

portfolios, catering to diverse customer needs. Here's a breakdown of the

standout offerings from key banks:

- Residential

Loans

- Public

Bank leads with 42.2% of its portfolio in residential loans, highlighting

its strong emphasis on home financing.

- CIMB

and Maybank follow with 34% and 30.2%, respectively.

- Working

Capital Loans

- Maybank

dominates this category, allocating 30.1% of its portfolio to working

capital loans. CIMB (24.8%) and RHB (33%) are also significant

contributors.

- Purchase

of Transport Vehicles

- Public

Bank stands out with 17.9% of its portfolio dedicated to vehicle

financing, followed by Hong Leong Bank at 11.5%.

- Personal

Financing

- Affin

Bank has a strong presence in this segment, with 11.2% of its portfolio

focused on personal loans. Aeon Credit also shines here with 34.3%.

- Construction

Loans

- Maybank

leads construction financing at 3.7%, closely followed by CIMB (2.3%) and

RHB (3.1%).

For those seeking specific types of loans, understanding

these bank profiles can help in selecting the right financial partner.